(Original title: What happened? In less than a day, FTX was abandoned by Binance? Cryptocurrencies fell across the board, FTX tokens fell by 60%, and Bitcoin fell by nearly 14%)

The liquidity crisis of FTX.com, a cryptocurrency trading platform, has resurfaced.

Less than a day after the exchange proposed by Changpeng Zhao, the richest man in the currency circle, proposed to acquire FTX.com, Binance announced its withdrawal from the acquisition due to the discovery of its huge financial black hole and regulatory risks, triggering another collective plunge in cryptocurrencies.

“As a result of the company’s due diligence, coupled with news reports of mishandling of client funds and investigations by U.S. regulators, we have decided not to proceed with the potential acquisition of FTX.com.” Binance tweeted at 5 a.m. Beijing time on November 10. Wen said. “Our initial intention was to provide liquidity to FTX clients, but the issues were beyond our control and ability to help.”

Image source: Screenshot of Binance tweet

Binance’s decision once again sparked concerns about risk contagion in the cryptocurrency circle, and the price of the currency fell.

According to Yingwei’s financial data, among the top ten cryptocurrencies in the world, except for the three stablecoins Tether (USDT), USD Coin and Binance USD (BUSD), other cryptocurrencies have fallen by at least 10% in the last 24 hours. Among them, Ethereum (ETH), the fourth-ranked Binance token BNB, the seventh-ranked XRP and the tenth-ranked Polygon (MATIC) all fell by more than 15%.

Image source: Yingwei Caiqing

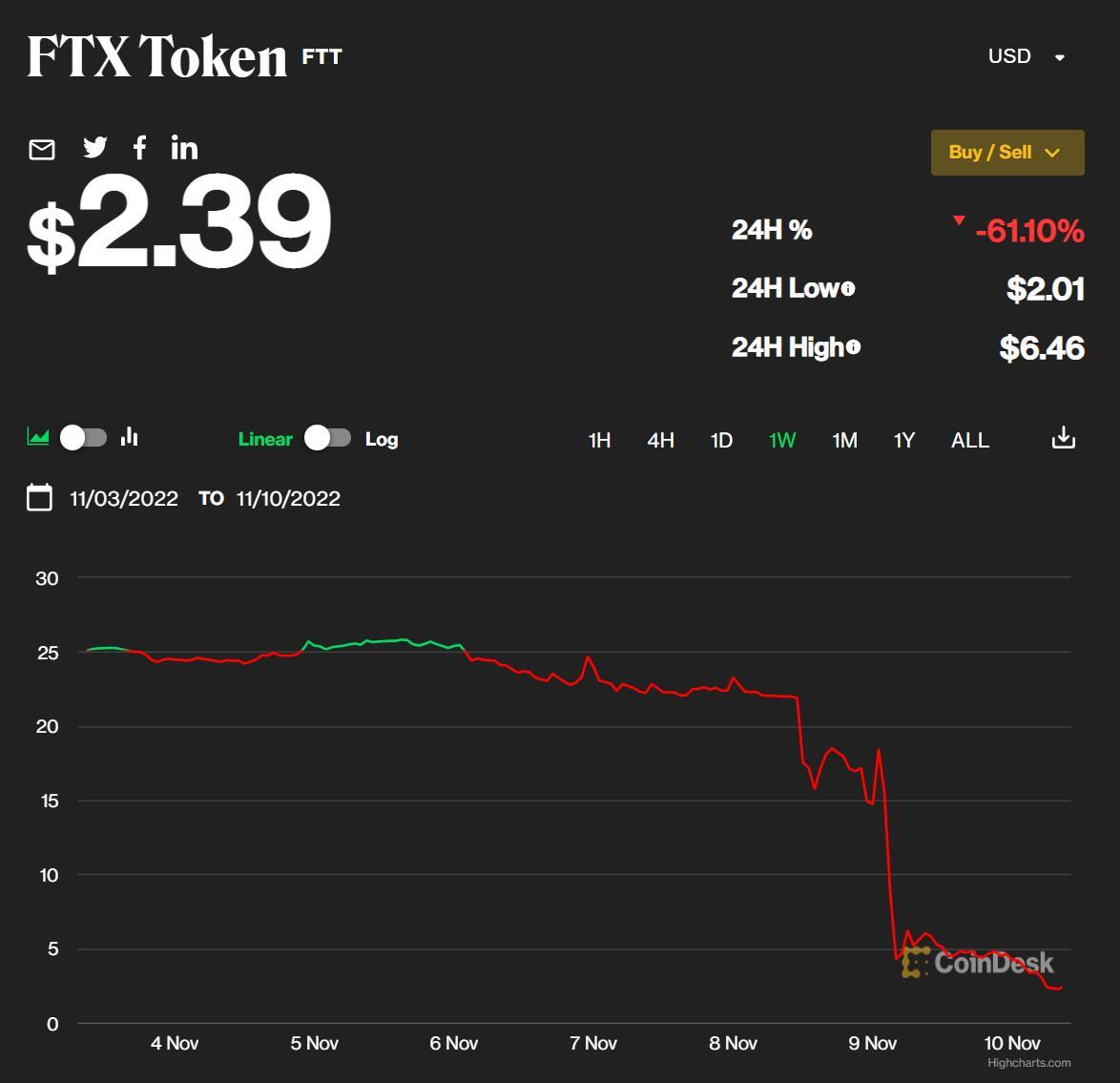

As of press time, Bitcoin fell 13.59% to $16,019.50, after falling below $16,000 for the first time since November 2020; Ethereum fell 15.49% to $1,109.28; FTX’s token, FTT, fell by more than 60% on a daily basis. Prices have fallen nearly 90% this week.

Image source: Screenshot from Coindesk

According to Bloomberg, Binance discovered the problem was worse than expected just hours after announcing its intent to acquire it. The gap between FTX.com’s debt and assets could be as high as $6 billion, according to people familiar with the matter. Additionally, the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) are investigating whether FTX handled customer funds properly, as well as FTX’s relationship with its founder and CEO Sam Bankman-Fried’s other cryptocurrency institutions such as Alameda Research .

According to the Wall Street Journal, Sam Bankman-Fried said in a phone call with investors on November 9, local time, that the company hopes to raise at least $4 billion through equity financing due to the deterioration of liquidity runs caused by recent customer requests for withdrawals. According to the newspaper, FTX has a liquidity gap of as much as $8 billion.

FTX’s future is in limbo after Binance dropped the acquisition, and investors are expected to lose a lot. In the $900 million financing of FTX last year, participating institutions included SoftBank Group (9984: Tokyo, stock price 6872 yen, market value 11.85 trillion yen), Sequoia Capital, hedge fund Third Point and private equity firm Thoma Bravo.

Retail investors are already facing inability to withdraw cash. According to the top message of FTX’s official Telegram channel, the exchange has suspended the withdrawal of cryptocurrencies and fiat currencies.

European cryptocurrency investor Michael Turský said that he has tried several times since noon on November 9 to withdraw about $11,000 in assets. “Because of FTX’s brand and reputation, I never expected it to collapse within a few days. Even if it collapsed, I didn’t expect it to stop all withdrawals,” said Michael Turský.

At present, the reasons for FTX’s liquidity run are still unclear, but some investors have begun to question whether the connection between FTX and Alameda Research has exacerbated the crisis.

According to industry media CoinDesk last week, FTT is the largest single asset on the balance sheet of hedge fund Alameda Research, and as the former may fall into bankruptcy, FTX will also fall into a liquidity crisis. Both FTX and Alameda were founded by Sam Bankman-Fried.

Just a few months ago, Sam Bankman-Fried was regarded as the savior of the cryptocurrency industry. He once promised to give nearly 1 billion US dollars to rescue the cryptocurrency exchange in crisis, and won the title of “the central mother of the currency circle”. Now, his own company has come to the brink of life and death.

Binance also implicitly expressed its predictions about FTX’s fate in its announcement of withdrawing from the acquisition, “As the cryptocurrency ecosystem has become increasingly resilient over the past few years, we believe that over time, those outliers who misuse users’ funds will become more resilient. (Outliers) will be cleaned up by the free market.”

Statement: Securities Times strives for true and accurate information. The content mentioned in the article is for reference only and does not constitute substantive investment advice. Operational risks are based on this.

Download the official APP of “Securities Times” or follow the official WeChat account to keep abreast of stock market dynamics, gain insight into policy information, and seize wealth opportunities.