Zhang Yaoxi: Gold will remain strong in the short term, and it is expected to hit 1845 next week for adjustment

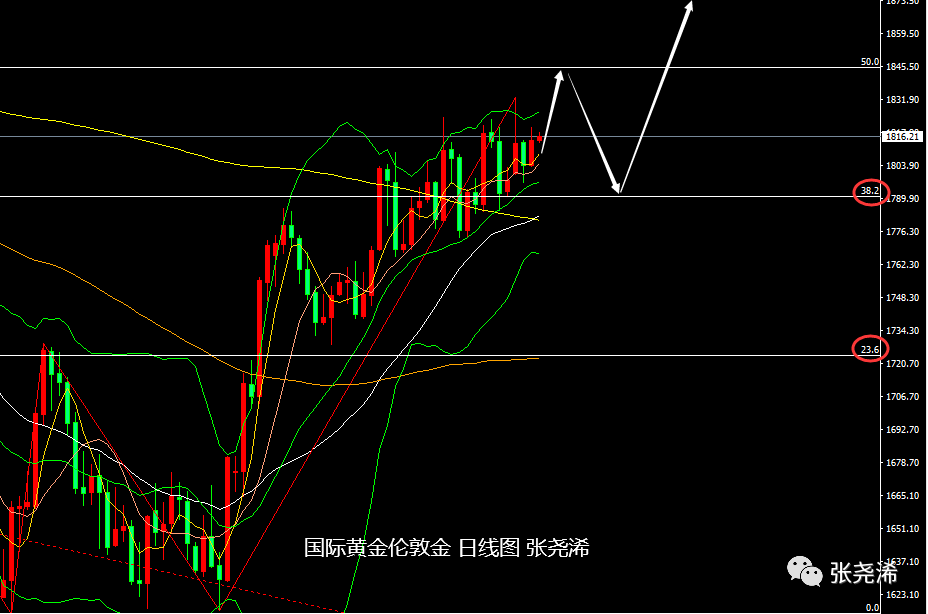

Last trading day on Thursday (December 29): International gold/London gold rebounded as scheduled and closed positive, but closed above the extension line again, and the Bollinger Bands are expected to open up again, suggesting that the market outlook still has the power to continue to strengthen. The weekly closing line continues to stay above this, which will increase this bullish expectation.

In terms of specific trends, since the Asian market opened at 1804.15 US dollars per ounce, the price of gold continued to recover overnight, and the US dollar index and US bond yields weakened first, which made it rebound, although it touched around 1812 US dollars during the European session , due to the economic bulletin released by the European Central Bank, the US dollar strengthened, which suppressed the price of gold and fell back, recording an intraday low of 1803.59 US dollars;

But since then, the bulls have made another effort and extended to the U.S. market. The initial jobless claims data showed that the U.S. job market has cooled as scheduled, alleviating concerns about the Fed’s intensification of interest rate hikes next year, putting pressure on the U.S. dollar index again, and boosting gold prices It further strengthened again, and finally after recording an intraday high of $1819.82, it was hit by the strength of the U.S. stock market and the U.S. dollar index bottomed out, and fell back again when it encountered resistance, closing at $1814.68, with a daily amplitude of $16.23 and closing up $10.53. An increase of 0.58%.

Other precious metals also rose: Spot silver closed up 1.52% at $23.892/oz; spot platinum closed up 4.27% at $1051.73/oz; spot palladium closed up 1.65% at $1815.25/oz.

Looking forward to today’s Friday (December 30): International gold continued to run strongly at the opening, and the U.S. dollar index and U.S. bond yields continued to fall at the opening and continued to decline yesterday, which boosted it.

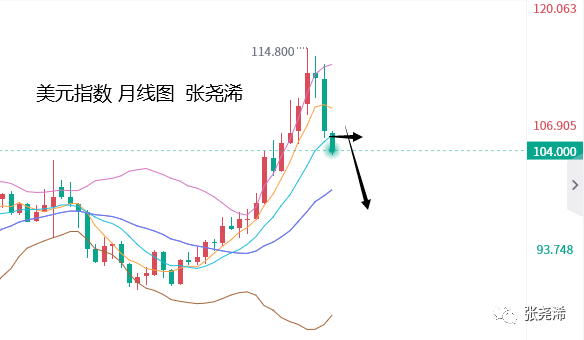

On the whole, although the U.S. dollar index maintains a low level and bottoms out in the daily chart, it is still running below the middle rail. In addition, the current trend is also below the short-term moving average again. The bullish signal of the MACD indicator in the attached picture has weakened, and the KDJ remains bearish. In the weekly and monthly charts, the short signal has also further strengthened, which implies that the US dollar index still has a large room for decline in the market outlook, so it will have an increased boost to gold. Therefore, in the future market, gold is still relatively weak Big room for rebound.

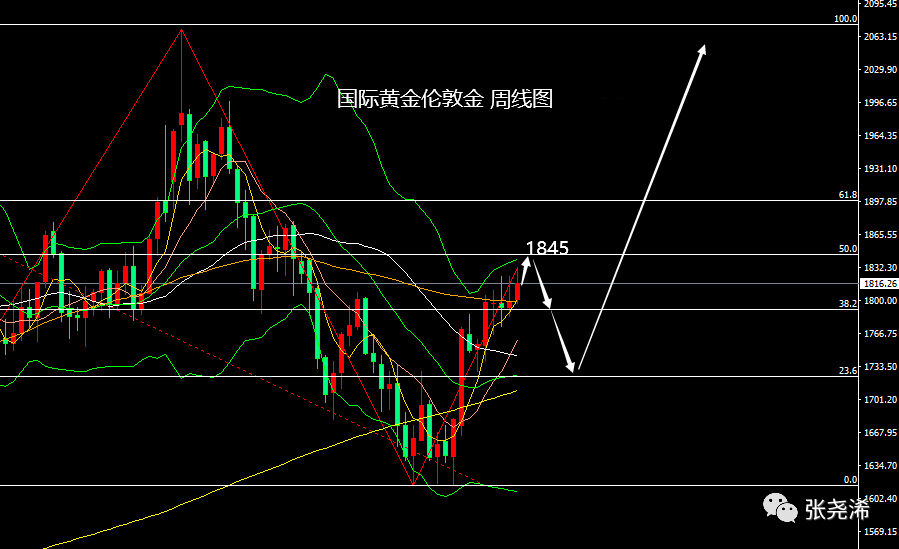

Pay attention to the final form of this week, and determine whether gold will pull back or continue to rise next week:

During the day, attention will be paid to the Chicago PMI data for December in the United States, which is expected to be bearish for gold prices. But the impact is expected to be limited. However, since the weekly and monthly lines are collected today, today’s closing price is particularly important. If the closing line is above $1,810 today, the market outlook is expected to reach $1,920, but if the closing line is below $1,810, the market outlook is expected to go out The pullback market has been mentioned repeatedly before, but the pullback still does not change the view that has been reversed and continues to be bullish. Therefore, the focus below is on the support of the 30-week moving average and the 200-week moving average, which is still a bullish entry point.

The risk of a gold callback can still be ignored, and we can seize the long-term bullish opportunity in the next two years:

Fundamentally, since the beginning of this year, the price of gold has been boosted by the geopolitical tensions triggered by the conflict between Russia and Ukraine, and the trend has once again approached a record high. But then, stocks, bonds and precious metals all took a hit from persistent inflation, interest rate hikes and economic concerns in the U.S. and elsewhere. Gold continued to decline in this environment, falling over $450;

By the latest fourth quarter, as the Fed’s interest rate hike expectations weakened and signs of easing inflation weakened the appeal of the dollar, gold prices bottomed out at about $200. Overall, gold still outperformed many other assets this year .

Now, as China further eases quarantine rules for those entering the country, it will weigh on the dollar, while early data this week has once again eased concerns about more aggressive rate hikes by the Federal Reserve next year;

In the long run, although the Fed is still raising the peak of interest rate hikes and prolonging the rate hike cycle, its strength has begun to weaken, and the pressure on gold prices has also diminished. At the same time, the market also has expectations that interest rate hikes will end soon It will support gold prices; inflation has also eased from the worst period, U.S. bond yields and the dollar will also fall, and gold prices may continue to recover. Gold prices will climb again in 2023,

Moreover, from the perspective of the annual trend, the overall trend is still in the bull market trend that started in 2001. In terms of strength, we can be optimistic in the next 10 years.

It is worth noting that in this trend, from 2013 to 2015, it closed down for three consecutive years, experienced a considerable adjustment and bottomed out. Now it has started to close down from 2021. Therefore, it may still maintain a shock adjustment in 2023, and it will start an upward mode in 2024. Therefore, in terms of operation, it is either to deal with shocks, or to wait to continue to climb and strengthen. Even if the low point is accidentally refreshed, you can quickly enter the market and wait for a long-term rise.

On the upside, as long as the double-top resistance of the past two years is broken, the market outlook will become a new floor support, which will start a long-term bull market climb again.

However, this year is also expected to receive a volatile cross-yang line. Therefore, there is a high probability that the current callback will be shorter than the continuous closing and falling cycle in 2013-2015. Therefore, next year or the year after is still another good opportunity for long-term bullish gold.

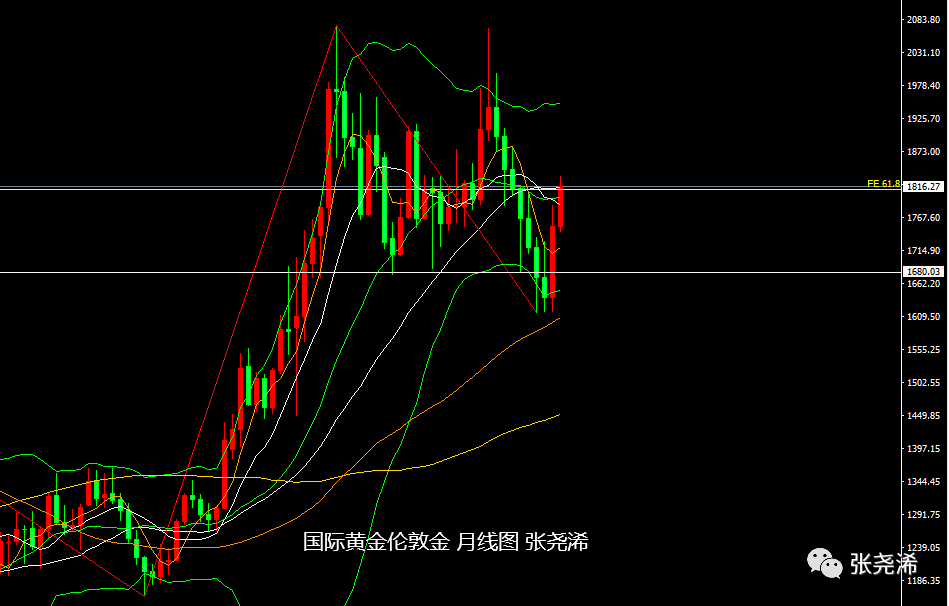

Technically: at the monthly chart level, the price of gold rebounded this month. It has repeatedly encountered resistance above the 30-month moving average and then retreated below it again. It is still difficult to stand above this resistance. At present, the monthly chart is about to close. It will close below this resistance, but the current trend remains above the middle rail, which implies that the bulls still occupy a dominant position. If the line closes above the middle rail this month, the market outlook can be supported by the middle rail and the October moving average for bullish entry field.

In view of the strong bullish momentum of the attached indicators, the rebound is also higher than the September-October highs. Therefore, the market has reversed in terms of trend. Even if there is a fall at the beginning of next year, it may touch the support of the moving average in October or May and continue to be bullish On the upside, wait for the pressure of the double top to be touched again. If the double top is broken, it will generate a further bull market.

Weekly level: Gold prices have strengthened again this week, and now the bulls have stabilized, with a strong rebound momentum. If the line closes above $1,811 this week, it will greatly weaken the inverted bearish pattern of the previous two weeks, and will once again To enhance bullish expectations for the market outlook, focus on the target resistance of $1,845 at the top, support at the 100-week moving average at $1,798 at the bottom, and support near $1,790 at the 38.2% retracement line.

Daily line level: Gold prices have recently maintained a volatile upward trend above the support of the middle rail, and are still running above the middle rail and the short-term moving average. In addition, the Bollinger Bands are expected to open up again, which implies that the bulls still have the dominant advantage, and the market outlook is expected It continues to strengthen, but the trend of the MACD fast and slow lines in the attached figure tends to move downward, implying that there is a risk of continuous correction in the market outlook. Above, we only need to pay attention to the target resistance of the Bollinger Band upper track and the resistance of the 50% retracement line. The bottom continues to be bullishly rebounded with the support of the middle rail and the short-term moving average.

Intraday preliminary point reference:

International Gold: Focus on support around $1810 and $1805 below; focus on resistance around $1826 and $1832 above;

Spot silver: Focus on the support of $23.75 and $23.60 below; the resistance of $24.15 and the resistance of $24.30 on the top;

Note:

Gold TD=(international gold price x exchange rate)/31.1035

International gold fluctuates by 1 US dollar, and gold TD fluctuates by about 0.22 yuan (in theory).

U.S. futures gold price = London spot price × (1 + gold swap rate × futures expiration days / 365)

Predict boldly, trade cautiously. The above viewpoints and analysis only represent the author’s personal thinking, and are for reference only, not as a basis for trading. your money your decision.

A must-have book for the basic skills of gold investment: “Playing and Earning Gold Investment Trading”