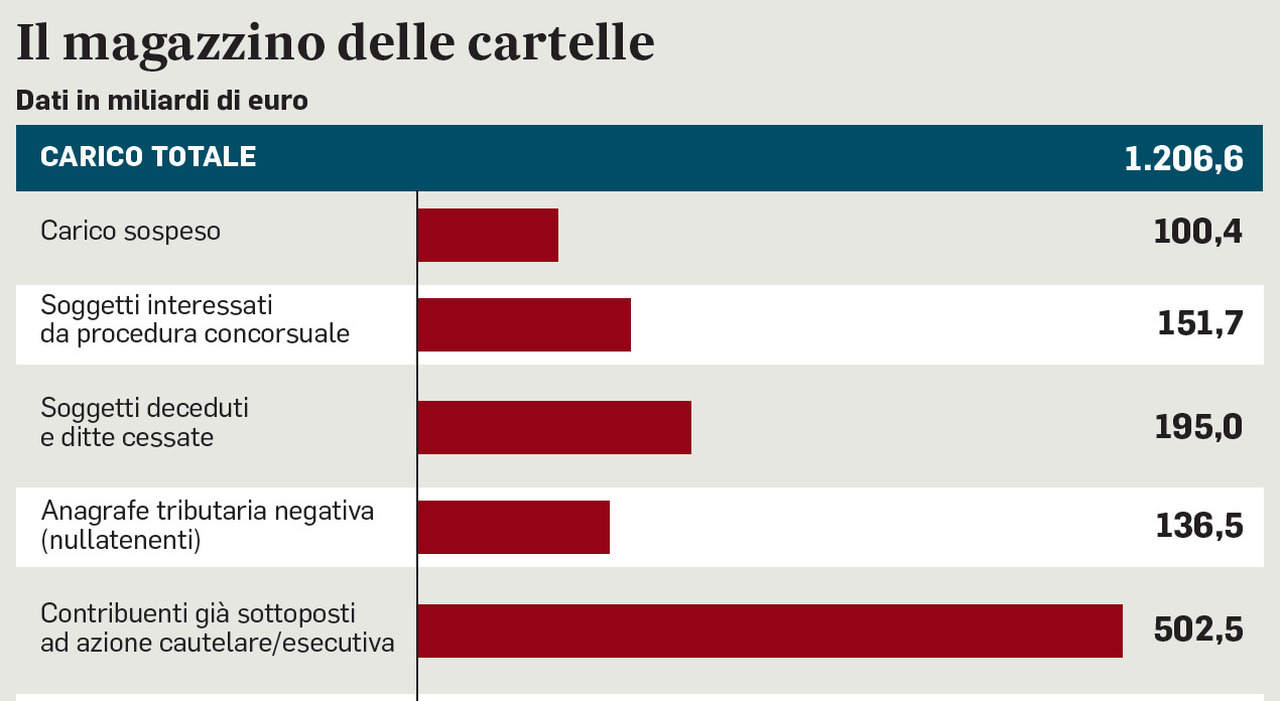

A new piece, the tenth, of the tax reform registered Melons, arrived unexpectedly at the Council of Ministers. And this is a fundamental piece, a crucial step especially for taxpayers. The legislative decree completely overhauls the tax collection system tax bills. And what promises to be a real revolution. In the warehouses of Tax there are 1,206 billion euros in back taxes not collected by the State. An enormous burden that hampers the Revenue Agency’s ability to collect, given that a large number of debtors are either dead, bankrupt or penniless. The provision signed by the deputy minister of Economy Maurizio Leo, father of the reform, promises to “relieve” the tax authorities from these old debts which are now almost completely uncollectable but, at the same time, promises to speed up collection by making it easier for taxpayers to settle their arrears with the Revenue Agency. “We help those who want to pay” but can’t, Leo said. Let’s start from this last point.

Tax bills, longer installments (from 72 to 120). Automatic cancellation after 5 years: here’s who is entitled to it

The tax bills that will be issued starting from January 1st of next year can be paid in installments, with an extension of up to 10 years (120 months in total), and which is added to the “ordinary” one of 72 months ( 6 years). The installment plan can also be extended, only once, for a period of the same duration (another 120 instalments). However, some distinctions must be made. The first is whether the debt with the State is greater or less than 120 thousand euros. Anyone who is below this threshold and will receive a tax bill in 2025 or 2026 will be able to obtain an installment of 84 installments, seven years. If the request is submitted in 2027 or 2028, the maximum installment payment will increase to 96 installments, eight years. From 2029 it will be possible to reach 108 installments, nine years at most. To obtain this extension it will be sufficient to declare that you are in a temporary situation of economic difficulty. What happens instead for those who have a debt with the tax authorities exceeding 120 thousand euros? In this case, first of all it will be necessary to “document” your difficulty in paying. The ISEE will be taken into account for natural persons, for businesses the liquidity index and the ratio between the debt to be paid in installments and the residual debt already in installments and the value of production will be taken into account. In this case, as mentioned, the extension can reach up to 10 years, 120 monthly installments. But even those who have debts of less than 120 thousand euros and demonstrate their difficult situation with the ISEE, and not with a simple declaration, will have more favorable conditions: the installment plan can also last up to 10 years for them. In the name of simplification, the way is also opened for mini compensations between tax bills and tax refunds. The “compensable” sum, however, cannot exceed 500 euros.

THE WAREHOUSE

The other step concerns, as mentioned, the “warehouse” of tax bills, i.e. the 1,206 billion in back taxes and penalties that the tax authorities have not yet managed to collect. Of these only 100 billion are still considered collectible. The rest belongs to bankrupt or deceased individuals, or even those who have no property. The decree provides for the establishment of a commission composed of a section president of the Court of Auditors, even retired, and a representative, respectively, of the Department of Finance and the Department of General Accounting of the State. What should this Commission do? It will have to propose possible solutions, to be implemented with subsequent legislative provisions, to achieve the discharge of all or part of the aforementioned warehouse. What does it mean? That the old folders will have to be cashed in (even partially) or cancelled. In what times? By the end of 2025 all the older ones, i.e. issued between 2000 and 2010. According to the data released a few days ago by the director of the Revenue Agency Ernesto Maria Ruffini, this amounts to 335 billion, of which only 14 are still considered effectively collectible. By 2027, explains the provision, the bills with a date ranging between 2011 and 2017 will have to be “downloaded” (approximately another 325 billion, of which 19 are still considered collectable). And, finally, by 2031 all folders dated up to 2024 will have to leave the warehouse. And what about the future? The bills that are not collected within 5 years will be returned to the institutions that issued them. Who, at that point, will be able to proceed directly with collection attempts or will be able to entrust them to private collection companies via tender. Or again, they can ask the Revenue Agency for another attempt. But the objective is that billions of uncollected tax bills no longer accumulate in the tax warehouse.

© ALL RIGHTS RESERVED

Read the full article at

The messenger