Yemenat – special

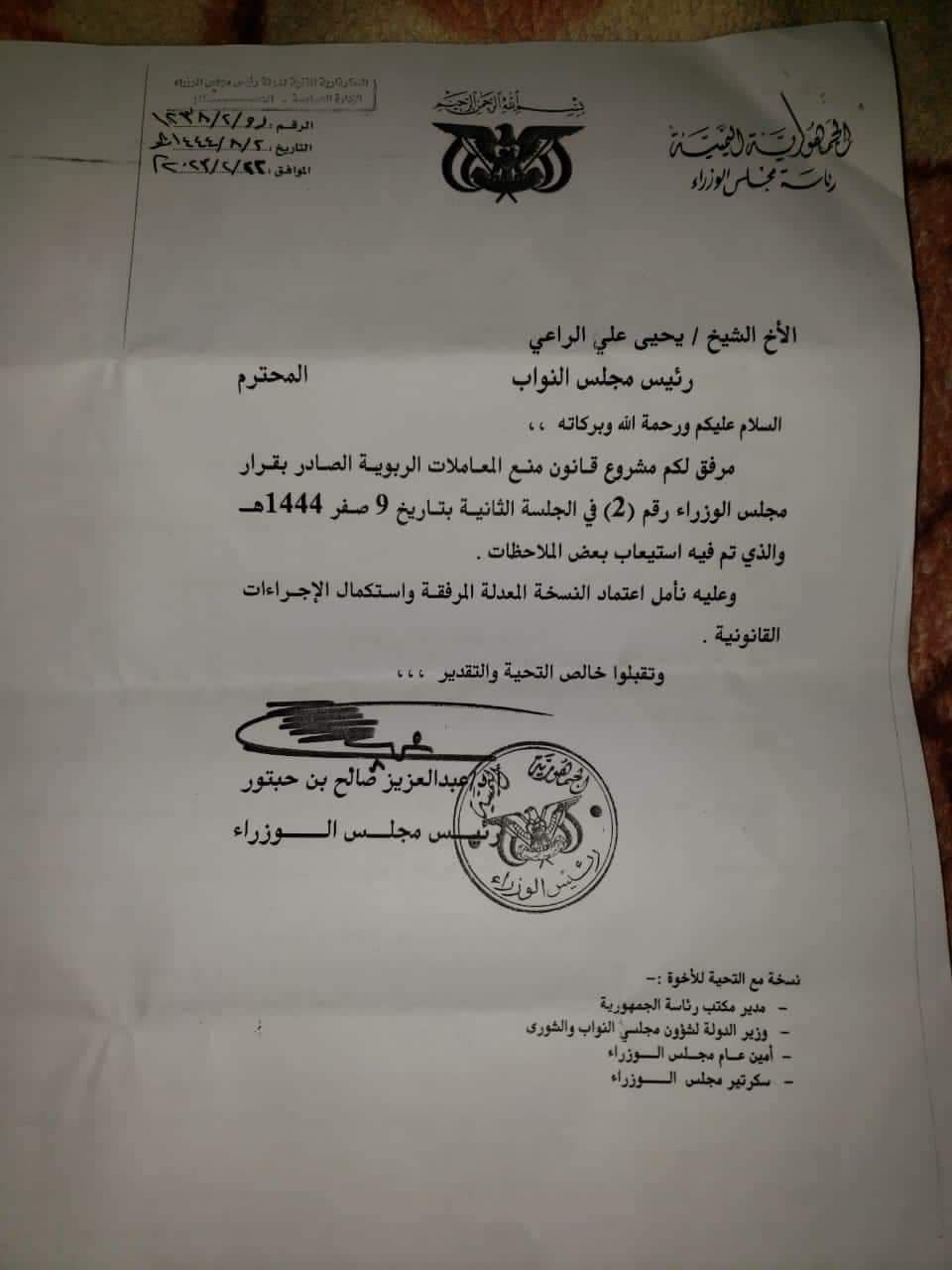

The Salvation Government returned the draft law to prevent usurious transactions to the House of Representatives for discussion, after it had withdrawn it on February 21, 2023, on the justification of completing the observations.

In its memorandum addressed to the House of Representatives on February 22, 2023 (one day after the draft law was withdrawn), the government sent the bill back to Parliament, indicating that the observations on it had been completed.

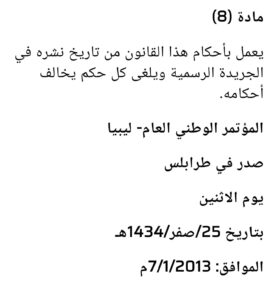

The withdrawn version of the draft law was an almost exact copy of the law to prevent usurious transactions issued in 2013 by the Libyan National Congress (Libya’s parliament at the time), a law that was adopted by hardliners from extremist groups that were active in the Libyan public scene. It could not be implemented by the banks, as it undermines the banking work, which is what made the Libyan House of Representatives, which came after the National Conference, suspend its implementation.

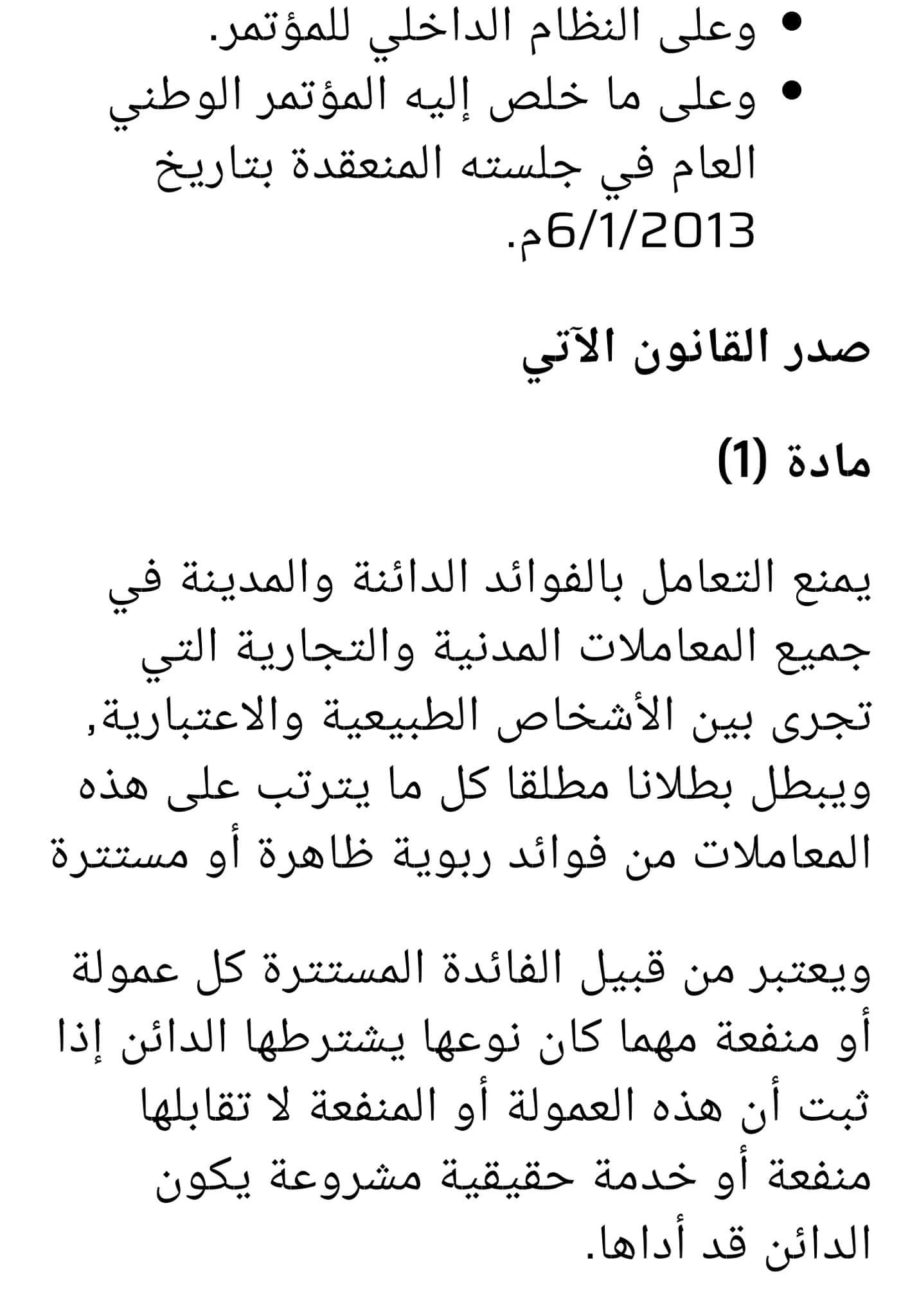

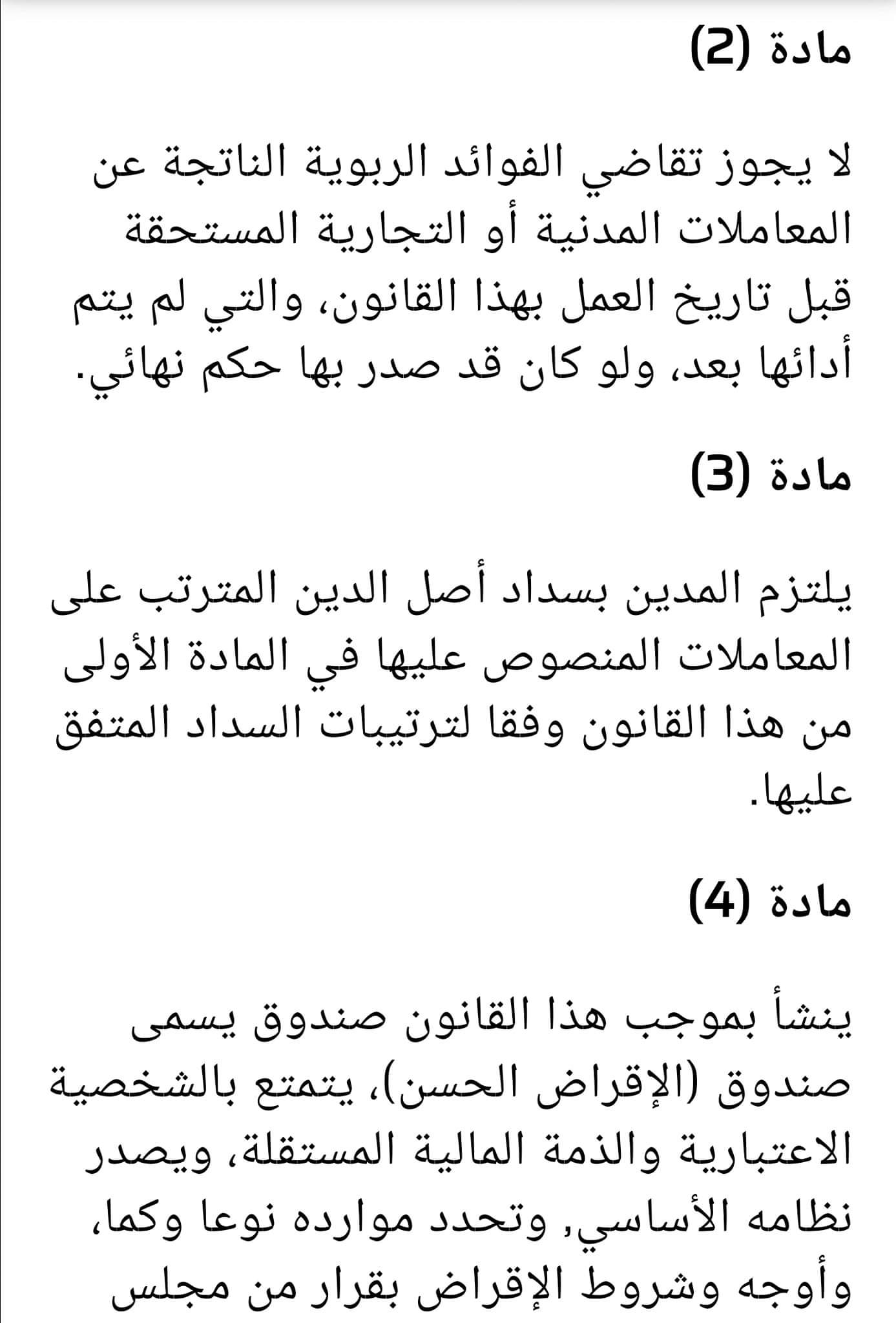

The text of the Libyan usurious transactions prevention law

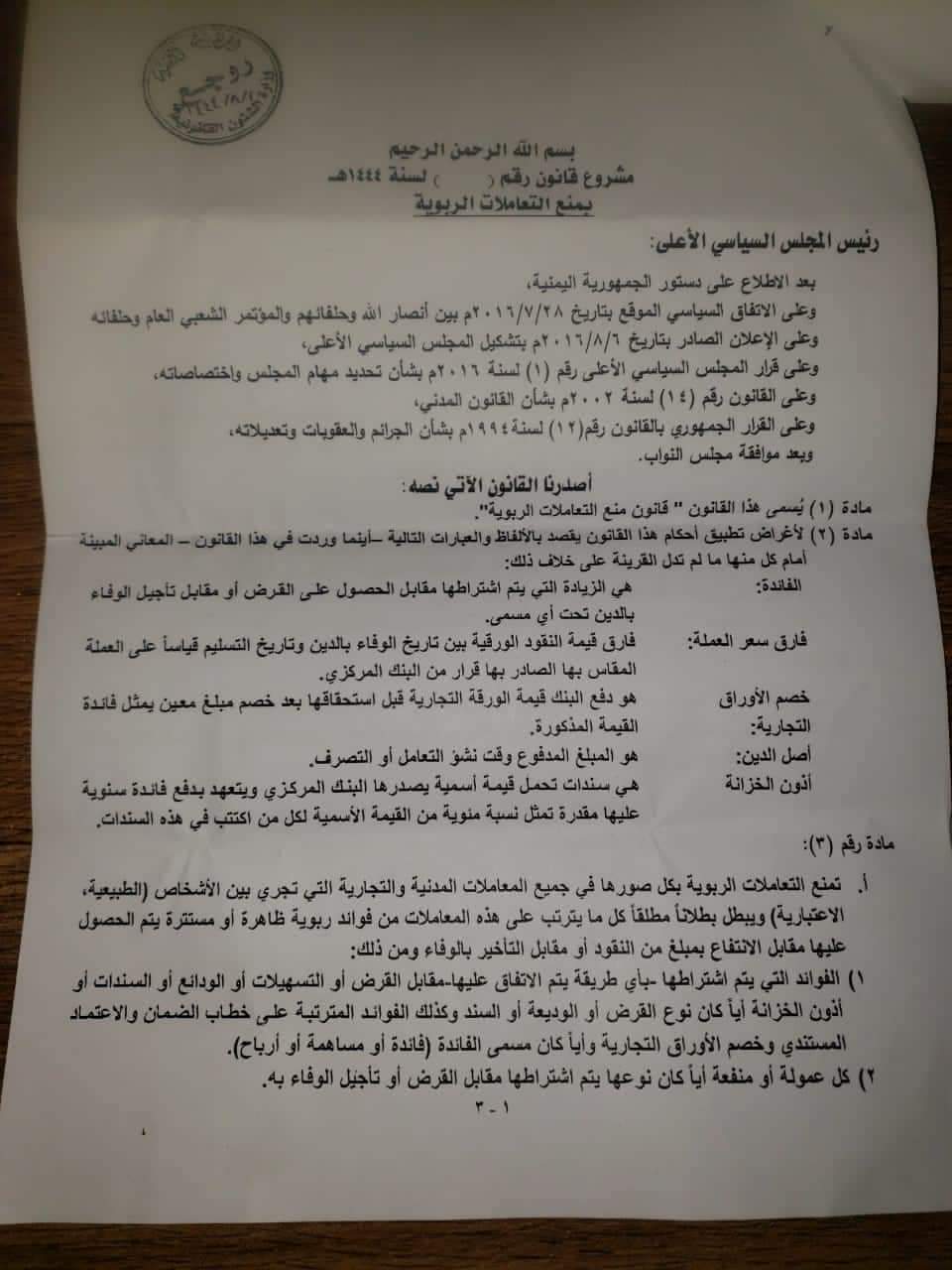

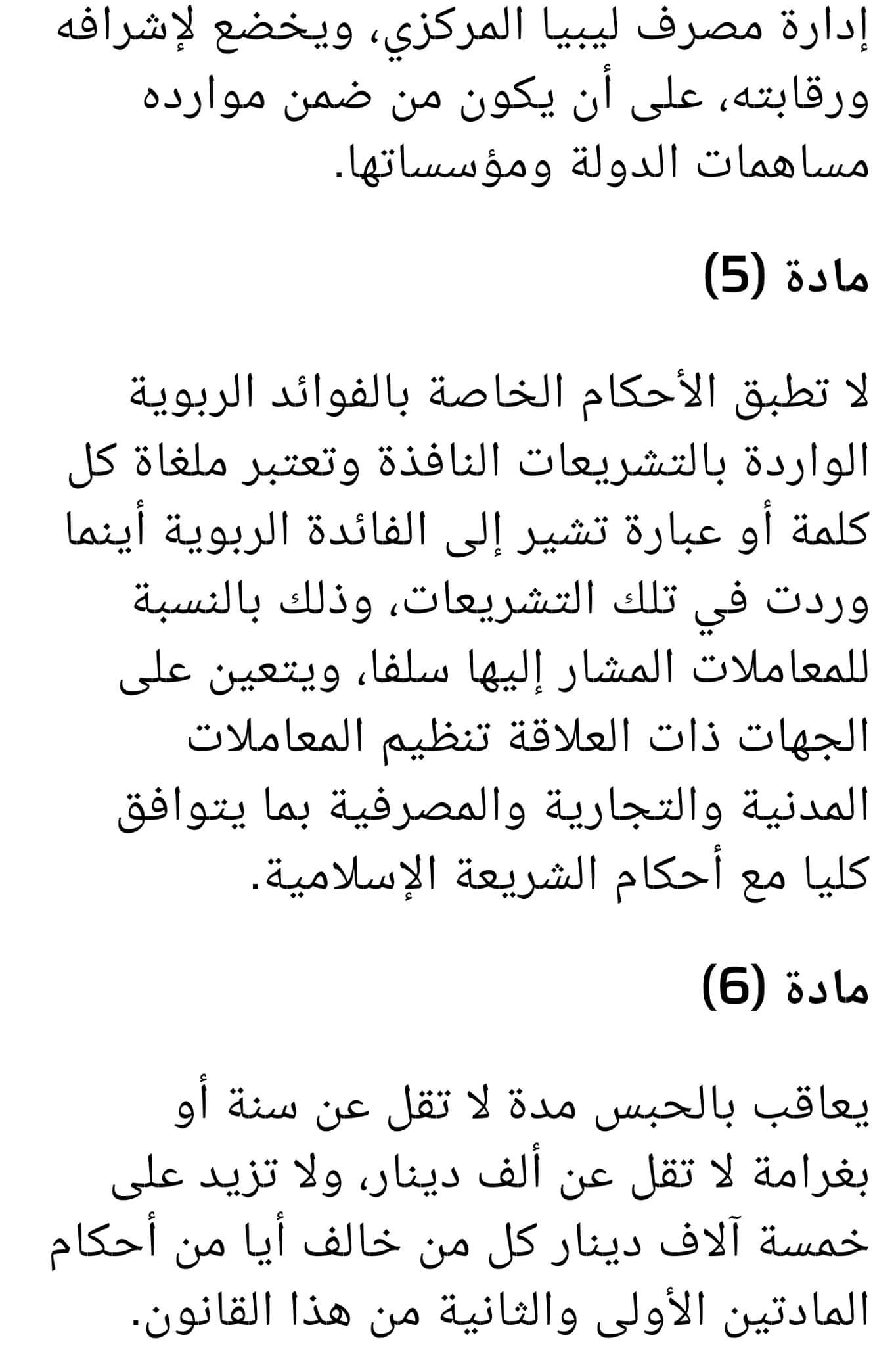

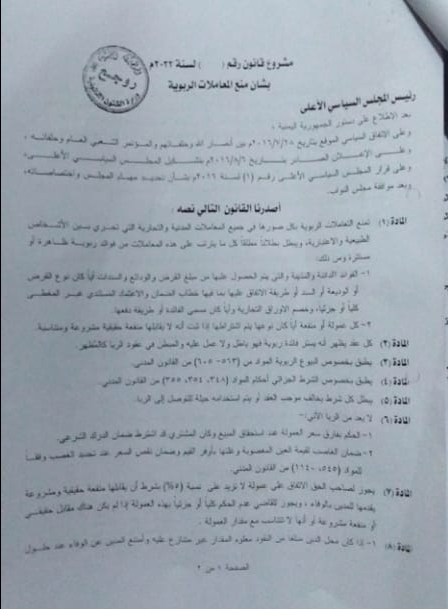

Draft text of the usurious transactions law in Sana’a before it was withdrawn

And the draft law to prevent usurious transactions adopted by the de facto authority in Sana’a (Ansar Allah “Houthis”) was presented to Parliament in June 2022, then withdrawn after sharp criticism, to be returned again to Parliament in September 2022, but disputes prevented it from being put forward. For discussion, especially after the objection of the leadership of the Central Bank, and the observations put forward by the Chamber of Commerce and Industry, the Federation of Banks and the Association of Money Changers.

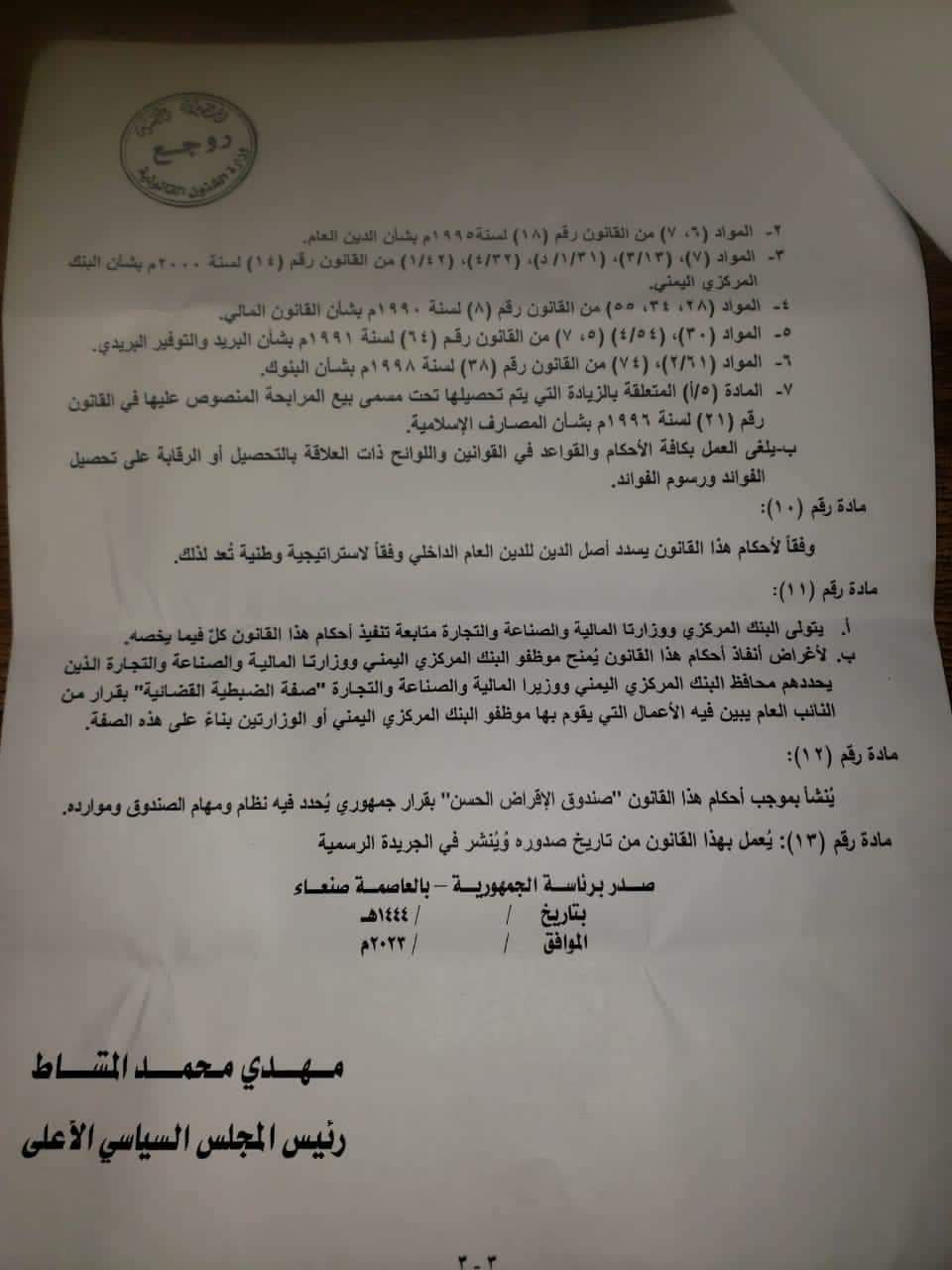

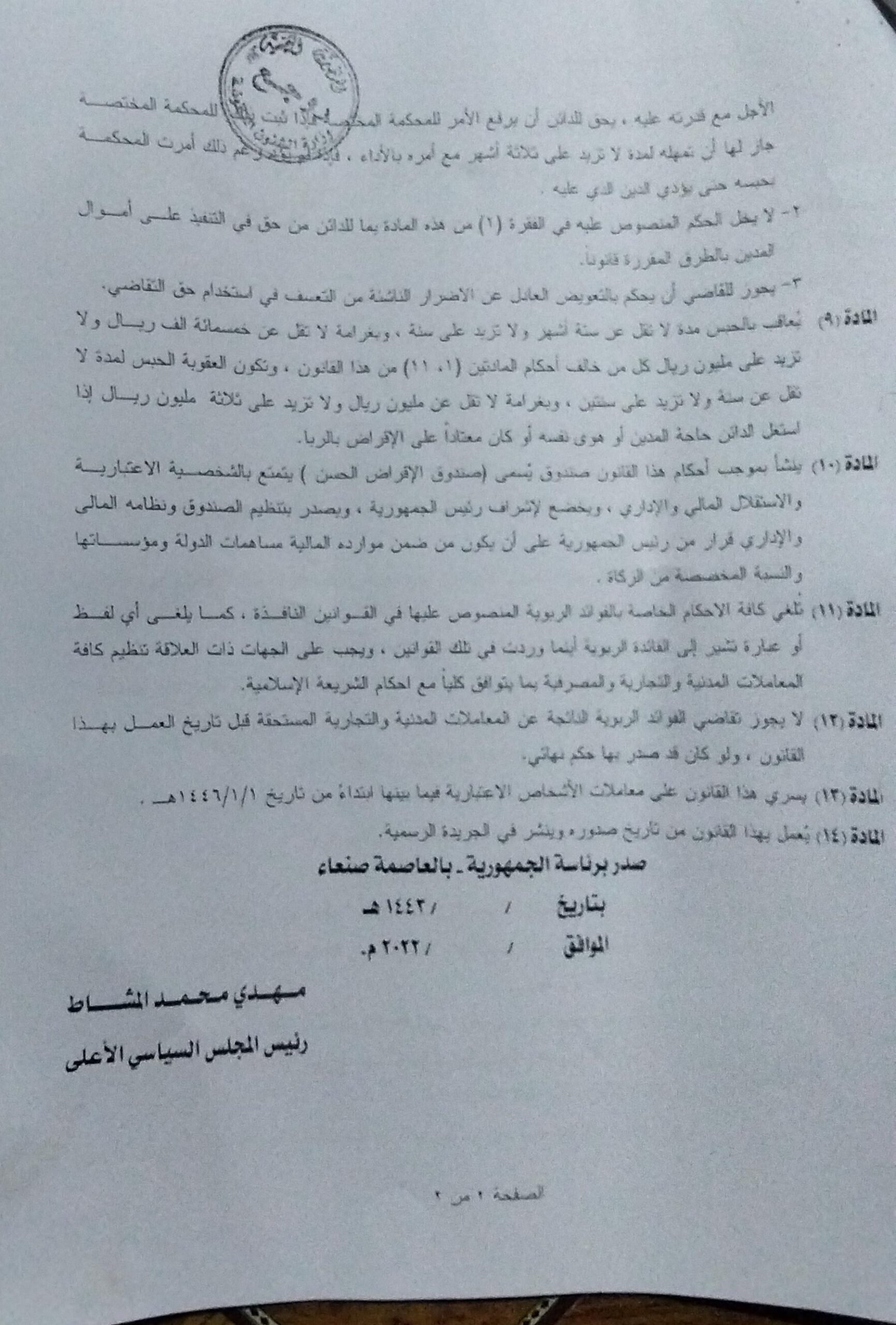

The amended draft law that was returned to the House of Representatives in Sana’a, and despite the amendments made to it, remains a threat to the banking system, according to researchers and those interested in the financial and banking system, as they considered that returning the draft law to the House of Representatives is an insistence on destroying the economic sector, noting that the approval of This project will pave the way for the plundering of people’s money and the liquidation of banks and banks, which operate in accordance with international treaties and agreements, and violating them means not dealing with them externally, which will force them to close their branches in the governorates under the control of the Sana’a authorities, especially since the law explicitly stipulates the cancellation of the work of international agreements that contradict with his texts.

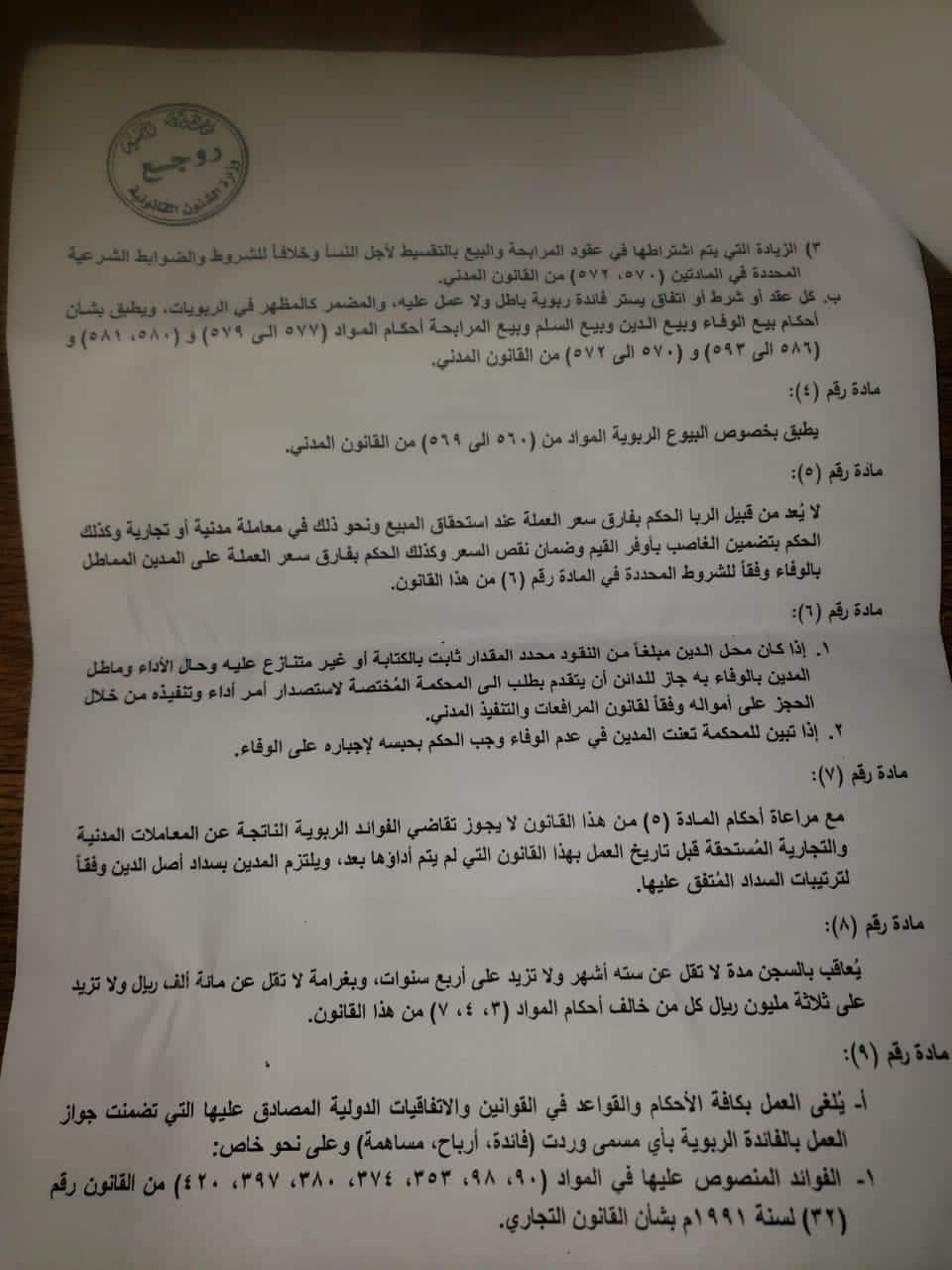

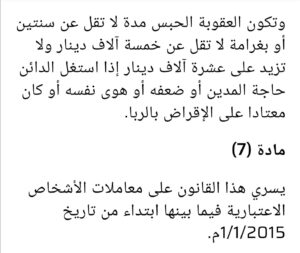

The text of the draft law to prevent usurious transactions after its amendment