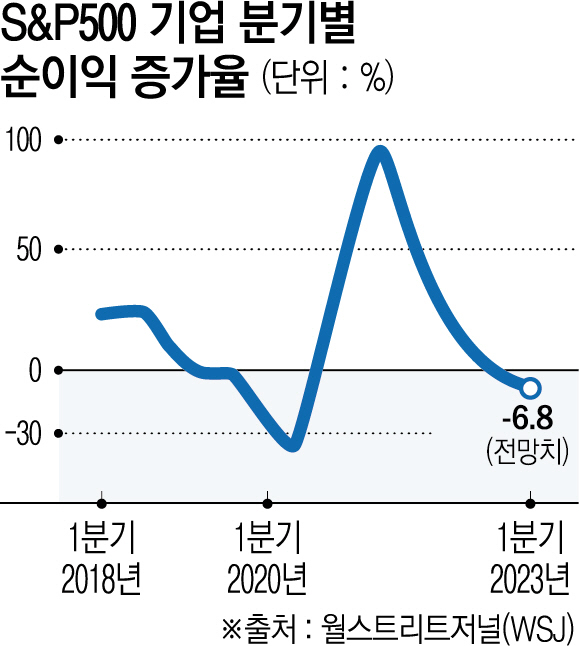

Worst since Q2 2020

Sales will likely stop growing by 1.8%

Pay attention to this week’s bank performance… Indicators for estimating the possibility of a credit crunch

Net profits of companies in the US S&P 500 Index are expected to decline for the second consecutive quarter. With the earnings season opening this week, the first quarter performance is expected to be a watershed that will determine the direction of the stock market, which is maintaining an upward trend despite a series of uneasy factors such as inflation, high interest rates, and the banking crisis following the Silicon Valley Bank (SVB) bankruptcy.

According to the Wall Street Journal (WSJ) on the 9th (local time), FactSet, a financial information company, predicted that the net profit of S&P 500 companies in the first quarter of this year would decrease by 6.8% compared to the same period last year. This is the largest decrease since the second quarter of 2020, when it was hit directly by the novel coronavirus infection (Corona 19) pandemic. Sales were expected to increase by only 1.8%. This would be the lowest revenue growth rate since the third quarter of 2020.

Eric Gordon, head of equity investment at Brown Advisory, said, “If you look at corporate earnings projections alone, we are already in a recession.”

Despite the prospect of deteriorating corporate performance due to the macroeconomic environment, the stock market has recently risen. The S&P 500 has risen 6.9% so far this year. In particular, big tech companies such as Apple and Microsoft (MS), which account for a high proportion of the S&P 500, performed well, driving the index up.

Wall Street is lowering corporate earnings expectations, but investors are still in a wait-and-see mood. The price-to-earnings ratio (PER) of S&P 500 companies is close to 18 times on average, exceeding the average of 17.3 times over the past 10 years. Anna Rathburn, Chief Investment Officer (CIO) of CBIS Investment Advisory, pointed out, “It makes no sense that technology stocks are showing an upward trend even when earnings expectations are lowered.”

First of all, the market is paying attention to the performance of major banks such as JP Morgan Chase, Citigroup, and Wells Fargo, which will be announced this week. This is because it can be a major indicator for estimating the possibility of a credit crunch. Depending on performance, banks can strengthen future lending standards, which is highly likely to affect the adjustment of the base rate by the US Federal Reserve System (Fed).

“Expectations on earnings will decrease once stricter lending standards begin to affect the economy as a whole,” said Gordon. .