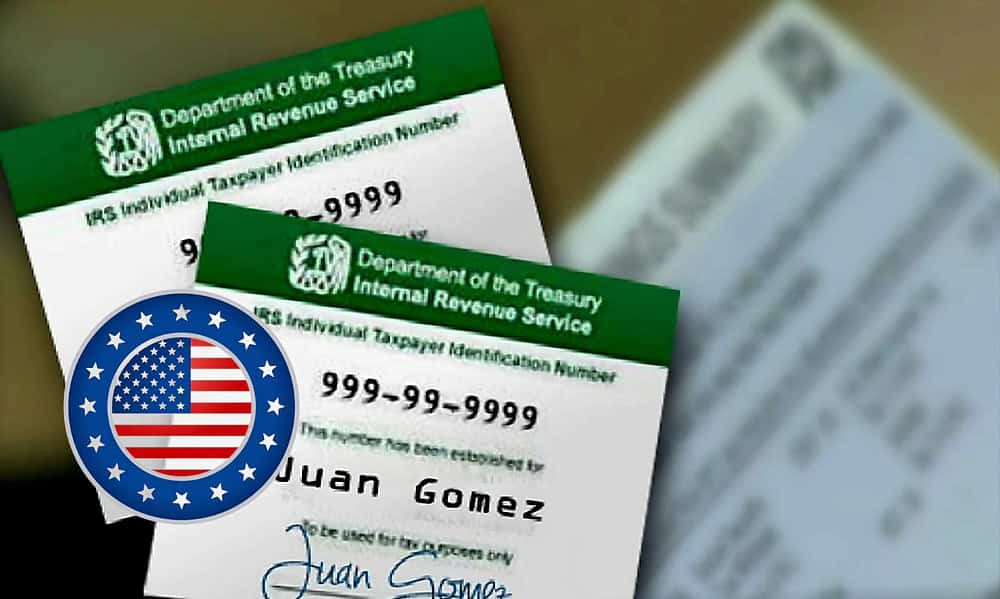

As the end of the year approaches, it’s important for U.S. taxpayers to be aware of the expiration of certain ITIN numbers. Failure to renew these numbers could result in delays in receiving tax refunds and could also prevent individuals from filing their taxes in 2024.

ITIN numbers serve as access keys to the Internal Revenue Service (IRS) system, allowing individuals to file their tax returns. However, certain ITIN numbers are set to expire on December 31, which means they will no longer be valid for use in tax returns. This includes numbers that have not been used to file federal taxes at least once between 2020 and 2022.

The expired ITIN numbers include those with the digits “70” through “88” as well as “90” through “99” that were assigned before 2013. If you possess one of these ITIN numbers, it is essential to renew it as soon as possible in order to avoid any negative impact on your finances.

To renew an ITIN, individuals need to submit a completed Form W-7, IRS Individual Taxpayer Identification Number Application, along with their United States federal tax return, photo identification documents, birth certificate, and date of entry into the United States. These documents should be mailed to the Internal Revenue Service, ITIN Operation, PO Box 149342, Austin, TX 78714-9342. The renewal process typically takes six to eight weeks.

Failure to renew an ITIN number could have serious repercussions for individuals’ finances, including delays in receiving tax refunds and an inability to file taxes in the future. Therefore, it is crucial for anyone with an expiring ITIN number to take the necessary steps to renew it before the end of the year.