NO.1 On the evening of September 18, Lin Gang, deputy mayor of the Guiyang Municipal People’s Government, reported the situation of the major traffic accident on the Sanli Expressway.The license plate number of the vehicle involved in this accident is Gui A75868, which belongs to Guizhou Qianyun Group Co., Ltd. It is a requisitioned vehicle for anti-epidemic transshipment, with 49 people on board.The car transported the quarantined personnel from Yunyan District to the Quarantine Hotel in Libo County, Qiannan Prefecture for centralized isolation and medical observation。

There were 47 people on board, including 1 driver, 1 staff member, and the remaining 45 were residents of Yunyan District.At about 2:40 on September 18, the vehicle rolled over 32 kilometers from Sandu to Libo Expressway in Qiannan Prefecture and fell into a deep ditch beside the road.As of 21:00 on September 18, a total of 27 people were killed in the accident, and 20 injured were sent to the nearest hospital for treatment.。

At present, the rescue work at the scene has been completed.The treatment of the injured and the aftermath of the victims are in progress, and the cause of the accident is under investigation。

Lin Gang said that this major traffic accident has brought huge losses to the lives and safety of the people, and we are extremely saddened and remorseful. The staff expressed their deep condolences and sincerely apologized to the whole society. (CCTV News)

NO.2 Follow the “Taiwan Hualien County” earthquake:

On the afternoon of September 18, an earthquake of magnitude 6.9 occurred in Hualien County, Taiwan (23.15 degrees north latitude, 121.30 degrees east longitude), with a focal depth of 10 kilometers. A building in Yuli Township, Hualien County collapsed due to the earthquake, and personnel from the police and fire department went to the scene to conduct search and rescue. It is understood that all four trapped persons in the collapsed building in Yuli Town have been rescued. In addition, according to local people’s reports, the deck of Gaoliao Bridge in Yuli Township, Hualien has been broken into several pieces.

Zhu Fenglian, a spokesperson for the Taiwan Affairs Office of the State Council, said on the 18th that relevant parties in the mainland are highly concerned about this, express condolences to the families of the victims, express condolences to the injured, and hope that the affected people will return to normal production and living order as soon as possible.。

The person in charge of the Earthquake Prediction Center of the Taiwan Meteorological Department said that at 14:44 on the 18th, the 6.9-magnitude earthquake that occurred in Hualien County, Taiwan was the largest earthquake this year.The 6.5-magnitude earthquake that occurred in Taitung County, Taiwan on the evening of the 17th was a foreshock. The 6.9-magnitude earthquake was the main shock, but it is predicted that there will be no aftershocks larger than this round of more than 70 foreshocks.。

According to the China Earthquake Networks Center, the earthquake with a magnitude of 6.9 in Hualien, Taiwan on September 18 and the earthquake with a magnitude of 6.5 in Taiwan on September 17 were earthquake swarms in the same area, and the two epicenters were about 14 kilometers apart. The earthquake caused strong tremors on Taiwan Island.The quake was clearly felt in coastal areas such as Fujian, Guangdong, Jiangsu and Shanghai. (Comprehensive CCTV News)

NO.3 The State-owned Assets Supervision and Administration Commission of the State Council recently issued the “Measures for the Compliance Management of Central Enterprises”, which will take effect on October 1, 2022. The “Measures” clearly statedA central enterprise shall establish a chief compliance officer based on the actual situation, without adding new leadership positions and positions, and the general counsel shall serve concurrently.. The Measures propose that,Central SOEs should embed compliance review into the business management process as a necessary procedure, and the compliance review opinions on major decision-making matters should be signed by the chief compliance officer, giving clear opinions on the compliance of decision-making matters. (Official website of SASAC)

NO.4 According to the issuance arrangement, there are 15 new shares available for subscription this week (September 19 to 23), including 4 on the Science and Technology Innovation Board, 4 on the ChiNext, 3 on the Beijing Stock Exchange, and 1 and 3 on the Shanghai and Shenzhen Main Boards respectively. . A total of 5 new stocks broke on the first day in August, andSince September, 6 new stocks have broken on the first day. On the first day of September, the new stock with the biggest drop was Jiaman Apparel. On September 9, Jiaman Apparel was listed on the Growth Enterprise Market. The opening price was 34.01 yuan, which was 16.36% lower than the issue price of 40.66 yuan, and the lowest intraday price was 33.9 yuan. As of the first day, it closed down 16.31%. Calculated at the lowest price of the day,The largest loss of 500 shares in the first batch is 3380 yuan. (Daily Economic News)

NO.5 On September 17, the topic #日食店 was reported to sell food from the origin of nuclear radiation# rushed to the hot search on Weibo. According to public information on the Credit China website, recently,Hangzhou Seven Seven Catering Management Co., Ltd.He was fined 38,944 yuan by the West Lake Scenic Area Bureau of Hangzhou Market Supervision Administration for selling unlabeled prepackaged food. Disclosed in this penalty information,The store claims that the ingredients come from Japan, most of which are sourced from a seafood center in Qingdao, a farmers market in Hangzhou, etc.. According to the Dianping App, the Japanese food store with the same business address disclosed in the punishment information,Per capita consumption is nearly 2000 yuan. (per synthesis)

NO.6 Economist Gao Shanwen wrote on the WeChat public account of “Gao Shanwen Economic Observation” on September 18, saying,Although the short-term trend is full of uncertainties, the current market is obviously at an undervalued level, and in the long-term it will surely experience a recovery to a reasonably higher level.. The recovery is based on the renewed expansion of household balance sheets and the continued competitiveness and creativity of the business sector that has been demonstrated over the past years.

NO.7 Recently, it was reported thatMany colleges and universities no longer enroll “specialized promotion”There are also various news on the Internet about the suspension of college admissions for “specialized promotion”, which has aroused the concerns of many students and parents of higher vocational (specialist) colleges and universities. The reporter interviewed a number of Jiangsu undergraduate colleges and found that when verifying the enrollment situation of “specialized promotion”,Jiangsu Province’s 2022 selection of outstanding junior college students to transfer undergraduate study plans to enroll normally, and the enrollment quota has increased by more than 2,000 on the basis of 2021. (Economic Daily)

NO.8 I bought a second-hand house, but the former owner owed more than 20,000 property fees. Recently, the People’s Court of Yueyanglou District, Yueyang City, Hunan Province heard the tort liability dispute case. The People’s Court of Yueyanglou District, Yueyang City held that the property management company had no right to cut off water and electricity to the owner. Even if it is a secondary water supply, the property management company has no right to stop the water supply, and the new owner, that is, the plaintiff in this case, is not obliged to pay the arrears of this part of the property fee. finally,The court of second instance upheld the original judgment, and the property management company restored the water supply to the house involved in the case (this has been completed), compensated the plaintiff for economic losses of 1,200 yuan due to the water cutoff, and apologized to him in writing.. (per synthesis)

NO.9 Domestic Epidemic Information

Shanghai: Further clarifying the “Sui Shen Code” and assigning five categories of personnel with red codes. First, those who were initially screened positive or mixed positive; second, confirmed cases, asymptomatic infections, and suspected cases; third, close contacts and close contacts; fourth, those entering China who are undergoing centralized or home isolation medical observation; Spillover personnel with a history of living in high school risk areas.

Chengdu, Sichuan: Since 0:00 on September 19, the city will resume production and life in an orderly manner. If you leave Chengdu by plane, you must hold a negative nucleic acid test certificate within 48 hours.。

September 18, 0-24:003 new cases of asymptomatic infection in Urumqiall in the Tianshan District.

September 18, 0-24:001 new confirmed case in Sanya, found among the quarantined control personnel. From 0:00 on August 1 to 24:00 on September 18, a total of 6,594 confirmed cases and 9,055 asymptomatic infections were found.

Tibet: 22 new cases of local asymptomatic infections from 0:00 to 14:00 on September 18。

Dalian, Liaoning: From 0:00 on September 19, the city’s normal production and life order will be restored in an orderly manner。

Guiyang: 8 typical problems of poor epidemic prevention were reported, and many cadres were dealt with。

NO.10 international News

According to a report by CNN on September 18, local time, according to statistics from a website that monitors power outages in the United States,Affected by Hurricane Fiona, Puerto Rico has lost power throughout the U.S. overseas territory. Puerto Rico Governor Pedro Perluisi confirmed the news and said local officials were using emergency protocols to help restore power.

On September 18, local time, the White House issued a statement,U.S. President Biden approves Puerto Rico’s declaration of emergency and orders federal aid to help Puerto Rico cope with the disaster caused by Tropical Storm Fiona。

According to Syrian state television, on the 18th local time,U.S. military base in Syria’s Deir ez-Zor province was hit by missiles.An explosion could be heard at the scene. After the attack, U.S. helicopters circled low over the base. No casualties have been reported so far.

On September 18, local time, the Japan Meteorological Agency announced that the typhoon “Nanmadu” made landfall near Kagoshima City, Kagoshima Prefecture, Kyushu, Japan at around 19:00 that day.。

The website of Russia Today TV reported on the 17th that an adviser to the French defense minister who did not want to be named disclosed to the American media a few days ago,France may be secretly training Ukrainian soldiers。

NATO Armed Forces Committee Chairman Ball revealed on the 17th that the defense ministers of NATO member countries held a meeting in Estonia to discuss how to maintain and increase support for Ukraine.Ball says NATO will support Ukraine as long as it needs it。

Since the outbreak of the Russian-Ukrainian conflict, NATO and the United States have continued to provide Ukraine with a large amount of weapons and equipment.to thisThe Russian side criticized that the transfer of weapons from the West to Ukraine would prolong the conflict between Russia and Ukraine and lead to more civilian casualties, and would also make Russia and NATO prone to direct military conflict.。

According to a report by Fox News on the 17th, a new video released recently recorded a picture of a U.S. Navy plane colliding with a bird in the air. The accident happened on September 19, 2021, and video footage showed a bird rushing over as the plane descended. In the end, the two pilots on the plane escaped before the crash with minor injuries, and the military plane crashed into a residential area in Texas, causing damage to at least one house. (Comprehensive CCTV News)

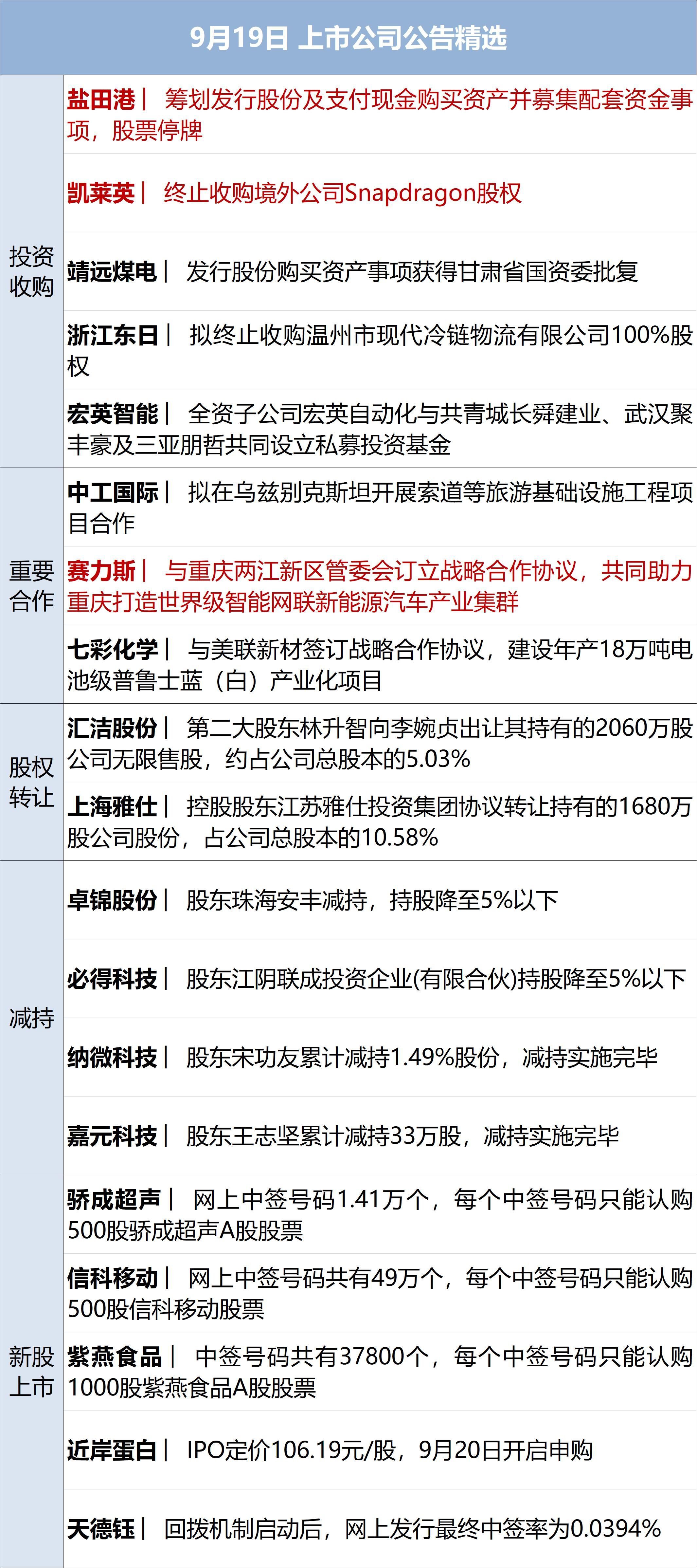

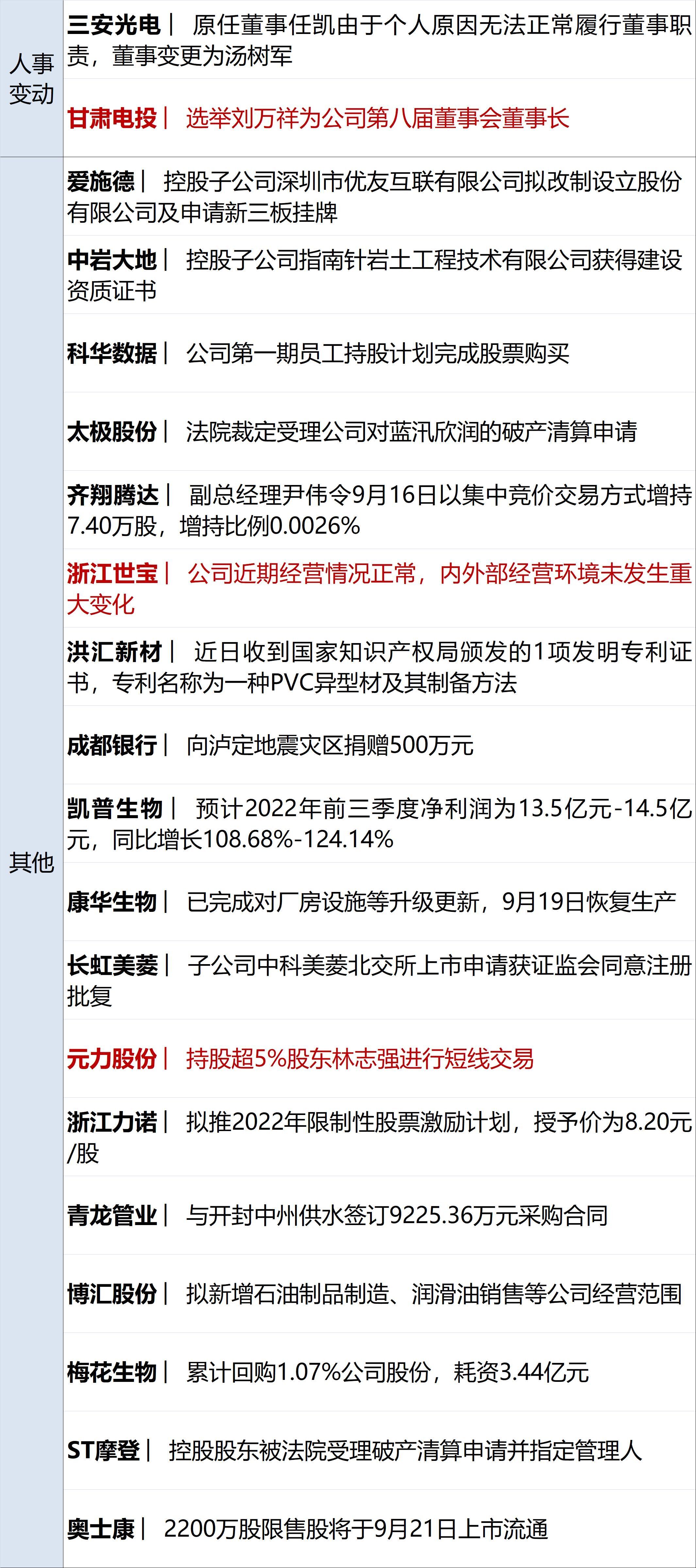

NO.1 Six thematic index ETFs approved:On September 18, the website of the China Securities Regulatory Commission released the approval for the registration of 6 ETFs. These 6 ETFs are Harvest SSE Science and Technology Innovation Board Chip ETF, Huaan SSE Science and Technology Innovation Board Chip ETF, Southern SSE Science and Technology Innovation Board New Materials ETF, Bosera Shanghai Stock Exchange. Science and Technology Innovation Board New Materials ETF, Huaxia CSI Machine Tool ETF, Cathay CSI Machine Tool ETF. High-quality listed companies in hard technology fields such as chips, new materials, and industrial mother machines may usher in a large amount of passive capital allocation. It is worth noting that these 6 ETFs just completed the receipt of materials on September 16. (Daily Economic News)

NO.2 China Telecom (SH 601728, closing price: 3.75 yuan, market value of 343.2 billion yuan):An announcement was issued on the evening of September 18, saying that at about 15:45 on September 16, 2022, the exterior facade of the second communication building of China Telecom Co., Ltd. Changsha Branch (the building where the property rights are not owned by a listed company) caught fire. In 2022 At 16:30 on September 16, the open fire in the building was put out, and the fire caused no casualties. The cause of the fire is under investigation. The fire accident is not expected to have a significant impact on the company’s production, operation and financial indicators.

NO.3 China Merchants Financial Holdings Limited:On the morning of September 18, the establishment and unveiling ceremony of China Merchants Financial Holdings Co., Ltd. was held in Qianhai. Meng Fanli, Secretary of the Municipal Party Committee, Qin Weizhong, Deputy Secretary of the Municipal Party Committee and Mayor, Miao Jianmin, Chairman of China Merchants Group, and Hu Jianhua, General Manager of China Merchants Group attended the event and jointly unveiled the China Merchants Financial Holdings. It is reported that China Merchants Financial Holdings Co., Ltd. has been officially established by the People’s Bank of China, becoming the third financial holding company in my country and the first financial holding company in the Guangdong-Hong Kong-Macao Greater Bay Area. (released in Shenzhen)

NO.4 Jinkong Coal Industry (SH601001, stock price 18.4 yuan, market value 30.8 billion yuan):It was announced on September 18 that an accident occurred in Tashan Mine on September 15, 2022, resulting in one death. On September 16, 2022, the company received the “Notice on Ordering Tongmei Datang Tashan Coal Mine Co., Ltd. Tashan Mine to suspend production for rectification” by the Shanxi Provincial Emergency Management Department and the Shanxi Provincial Local Coal Mine Safety Supervision Administration, requiring the holding subsidiary Tongmei University Tangtashan Coal Mine Co., Ltd. stopped production at Tashan Mine for rectification.

Wuzhou Special Paper (SH605007, stock price 15.04 yuan, market value 6.016 billion yuan):On the evening of September 18, the company issued an announcement that Jiangxi Wuxing Paper Co., Ltd., a wholly-owned subsidiary, had an accident during the shutdown and maintenance process on September 15, causing casualties. According to the “Order to Rectify within a Time Limit” issued by the Hukou County Emergency Management Bureau, Jiangxi Five-Star will stop production on the premise of ensuring production safety.

NO.5 Yang Zi, La Chapelle (HK06116, stock price of HK$0.26, market value of HK$142 million):Recently, after the endorsement of the brand Puella expired, she was sentenced to pay 250,000 yuan for her portrait of Yang Zi, and La Chapelle successfully appeared on the hot search. According to the Beijing Court Trial Information Network, recently, the first-instance and second-instance judgments of Yang Zi and Shanghai Youshi Garment Co., Ltd. for the online infringement liability dispute were made public. Yang Zi claimed that after the expiration of the “Puella” brand image spokesperson contract for the defendant’s sales and operation, the defendant still used his portrait pictures for advertising for two years without authorization, and still promoted it as the product’s spokesperson. , disrupting the commercial endorsement rules and infringing on Yang Zi’s portrait rights and reputation rights. Yang Zi requested 2.505 million yuan in compensation. In the end, the court of first instance ruled that the defendant immediately deleted the portrait of Yang Zi in the store, publicly apologized and compensated Yang Zi 250,000 yuan. The second instance upheld the original judgment. (per synthesis)

NO.6 Celis (SH601127, stock price 63.08 yuan, market value 94.44 billion yuan):Group official WeChat news, on September 17, Celis Group signed a strategic cooperation agreement with the Chongqing Liangjiang New Area Management Committee. According to the agreement, the Sailis new energy vehicle upgrade project will be settled in the Longxing Intelligent Connected New Energy Vehicle Industrial Park in Liangjiang New District, Chongqing.

NO.7 Apple (AAPL, $150.7, $242 million market cap):On September 16th, the first day of Apple’s new phone release was crazy. According to media reports, on September 17th, the iPhone 14 market returned to calm, and even broke. The 14 series currently broke 100-1000 yuan, and the scalpers who had not yet finished shipping the price increase machine were directly faced with the situation. loss. On September 18, “Cattles complained that Apple 14 was posted for 100 yuan” rushed to the hot search. (per synthesis)

NO.8 Capital Group, Fidelity Fund:Recently, although the overall A-share market is sluggish, overseas long-term investment giants are still increasing their positions in an all-round way. Compared with August 25, as of September 15, two ETFs under Capital Group’s investment scope including China have increased their positions in most Chinese stocks. Both ETFs have grown in size during this period. Fidelity Fund-China Focus Fund increased its positions in Tencent Holdings by 61.18%, Alibaba Hong Kong stocks by 17.66%, China Merchants Bank by 15.95%, Industrial and Commercial Bank of China by 9.47%, and Lenovo Group by 8.05%. Another fund owned by Fidelity, the China Consumer New Energy Fund, has also recently increased its exposure to Chinese internet stocks. (China Fund News)

NO.9 Amazon (AMZN, $123.53, $1.26 trillion market cap):On September 17, local time, the European Central Bank announced that five companies including Amazon will participate in the user interface (UI) prototype design of the digital euro. The five companies, CaixaBank from Spain, Worldline from France, Nexi SpA and EPI from Italy, and Amazon from the US, will each be responsible for a specific use of the digital euro. (interface)

NO.10 Arabian Drilling, a Saudi oilfield services company:Saudi Arabian Drilling, a Saudi oilfield services company partly controlled by Schlumberger, has hired Goldman Sachs, HSBC Holdings and SNB Capital to manage its initial public offering (IPO) in Riyadh, Bloomberg reported on September 18. Arabian Drilling will reportedly sell 26.7 million shares, or a 30 percent stake. The issue price will be determined after a cumulative bidding period from September 28 to October 5. (Interface News)

Investment interaction

Last week’s stock market summary:

Essence Securities concluded that recently, due to the negative factors of the U.S. inflation exceeding expectations in August (Fed hawkishness, U.S. stock market correction) and the pressure of RMB exchange rate depreciation, the A-share market experienced a certain correction, the northbound funds showed a state of outflow, the growth style was under pressure, and the market value of small and medium-sized enterprises was under pressure. The field fell deeply, the value of the broader market was relatively dominant, and the trading volume showed a shrinking state. As of last Friday, the Shanghai Composite Index fell 4.16% last week, fell below 3,200 points, and closed at 3,126.4 points, the Shenzhen Component Index fell 5.19%, and the ChiNext fell 7.1%.

Stock market forecast this week:

The analysis of BOC International pointed out that the current A-share adjustment is difficult to sustain, and investors need to cherish the allocation window after the panic evaporates. First, the resilience of US inflation is difficult to change the path of price decline. After the continuous interest rate hikes in the United States, recession is unavoidable. It is expected that the nominal interest rate of US bonds will fall faster than inflation, driving the real interest rate downward. Secondly, the two-way fluctuation of the RMB exchange rate is difficult to change, considering that the year-on-year high of domestic GDP will be at least in the second quarter of next year. , the basic orientation is good to support exchange rate stability. Thirdly, the upward capital expenditure of the track shares supports the improvement of the industry’s prosperity, and the short-term valuation squeeze is more of a good allocation opportunity; finally, whether it is from the turnover rate or the risk premium of stocks and bonds, the current A-share market valuation has been Entering the stage of underestimation, the margin of safety is highlighted.

This week, the market value of restricted shares lifted to 93.1 billion yuan

Wind data statistics show that this week (September 19 to September 23), 5.096 billion restricted shares will be lifted. Calculated at the closing price on September 16, the market value is about 93.132 billion yuan, an increase from last week respectively. 167%, 108.7%, in the weekly data of the whole year, the scale of lifting the ban this week is at a medium level. In terms of individual stocks, companies with a large number of lifted bans this week include CITIC Special Steel, Chuanfa Lomon, Ganzhao Optoelectronics, Yutong Optics, and Fulin Seiko.

IPO opportunity

The information disclosed so far shows that a total of 15 new shares were issued and subscribed this week. Among them, Shenghui Integration was listed on the main board of the Shanghai Stock Exchange; Bofei Electric, Oujing Technology, and Haoshanghao were listed on the main board of the Shenzhen Stock Exchange; Xinzhi Biological and Hualing shares were listed on the main board of the Shenzhen Stock Exchange. Listed on the Beijing Stock Exchange; Hong Rida, Yihao New Materials, Silane Technology, Fantuo Digital Innovation, and Vitex are listed on the Growth Enterprise Market; Wanrun New Energy, Nearshore Protein, Fuchuang Precision, and Bide Medicine are listed on the Science and Technology Innovation Board listed.

A-share market performance last Friday

Click to query。

Click to queryOne-click to identify meat sticks and thunder stocks, and you don’t have to worry about new ones.

CITIC Securities: Since September, the expectation of rapid overseas interest rate hikes has continued to increase, the incremental funds are limited, the position structure is unbalanced, and the fierce anticipation game has exacerbated market volatility. The side entry time is expected to be in October. From the perspective of market rhythm, the overall valuation of the current market is reasonable, and its absolute attractiveness is slightly lower than that at the end of 2018. There are opportunities for allocation on the left side, but we believe that after the economy, policies, and profit expectations are clear in October, and external geographical disturbance factors have been implemented, Entry on the right is more secure. In terms of configuration, it is recommended to be firm in “eager and cold”, and the focus will continue to shift to some unpopular industries in the early stage.

Every reporter: Liu Mingtao and Wang Fan

Every editor: Zhang Yangyun and Wang Xiaobo

Disclaimer: The content and data of the article are for reference only and do not constitute investment advice. Investors operate accordingly at their own risk.