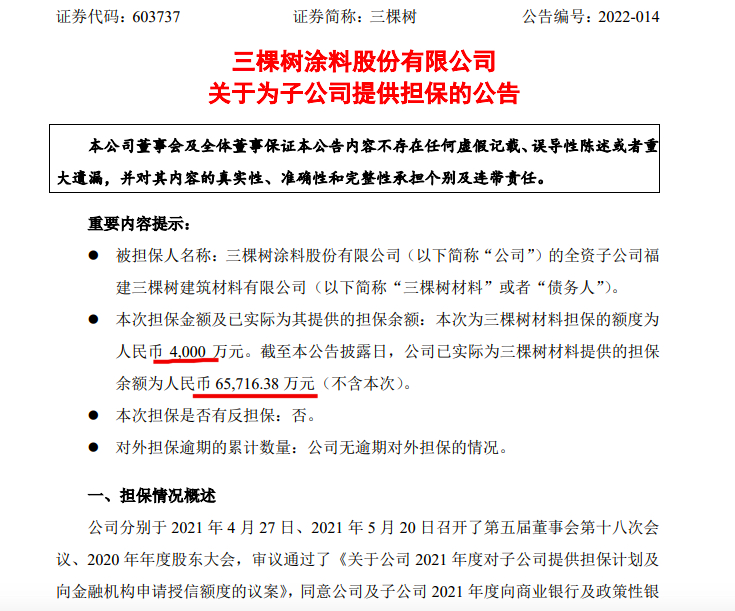

three treesCoatings Co., Ltd. (abbreviation:three trees603737.SH) released about the subsidiary Fujianthree treesGuaranteed by Building Materials Ltd.announcementsaid that the company intends toIndustrial BankCo., Ltd. Putian Licheng Sub-branch signed the “Maximum Guarantee”contract”, providing 40 million yuan of joint and several liability for the debts of 3trees Materials under the above-mentioned contractGuarantee Guarantee。

In the announcement, 3trees pointed out that in addition to this new guarantee, the company’s board of directors andshareholderThe amount of guarantee for subsidiaries in 2021 approved by the conference is RMB 6.500 million, of which the amount of guarantee for 3trees materials is RMB 1.50 billion. As of the disclosure date of this announcement, the balance of external guarantees of the company and its controlled subsidiaries is RMB 2,279,441,500 Yuan (excluding this time), the company’s guarantee balance for 3trees materials was RMB 657,163,800 (excluding this time), accounting for 26.20% of the company’s latest audited net assets, and there was no overdue external guarantee.

As of the disclosure date of this announcement, the total amount of external guarantees provided by the company and its controlled subsidiaries was RMB 6,873.6 million (including this time), accounting for 274.05% of the company’s latest audited net assets attributable to the parent; The total amount is RMB 6,523,600,000 (including this time), accounting for 260.10% of the company’s latest audited net assets attributable to the parent. The company does not have any overdue guarantees.

CDC Finance reported on January 30 that Three Trees released the 2021 annual report.performanceThe pre-loss announcement stated that, according to preliminary calculations by the financial department, the company expects to realize the profit attributable to shareholders of listed companies in 2021.net profitCompared with the same period of the previous year, there will be a loss, and the net profit attributable to shareholders of the listed company will be RMB -470 million to -320 million, a year-on-year decrease of 193.7%-163.8%; the company expects to be attributable to shareholders of the listed company in 2021. The net profit after deducting non-recurring gains and losses was RMB -616 million to -466 million, a year-on-year decrease of 245.8%-210.3%.

(Article source: CDC Finance)