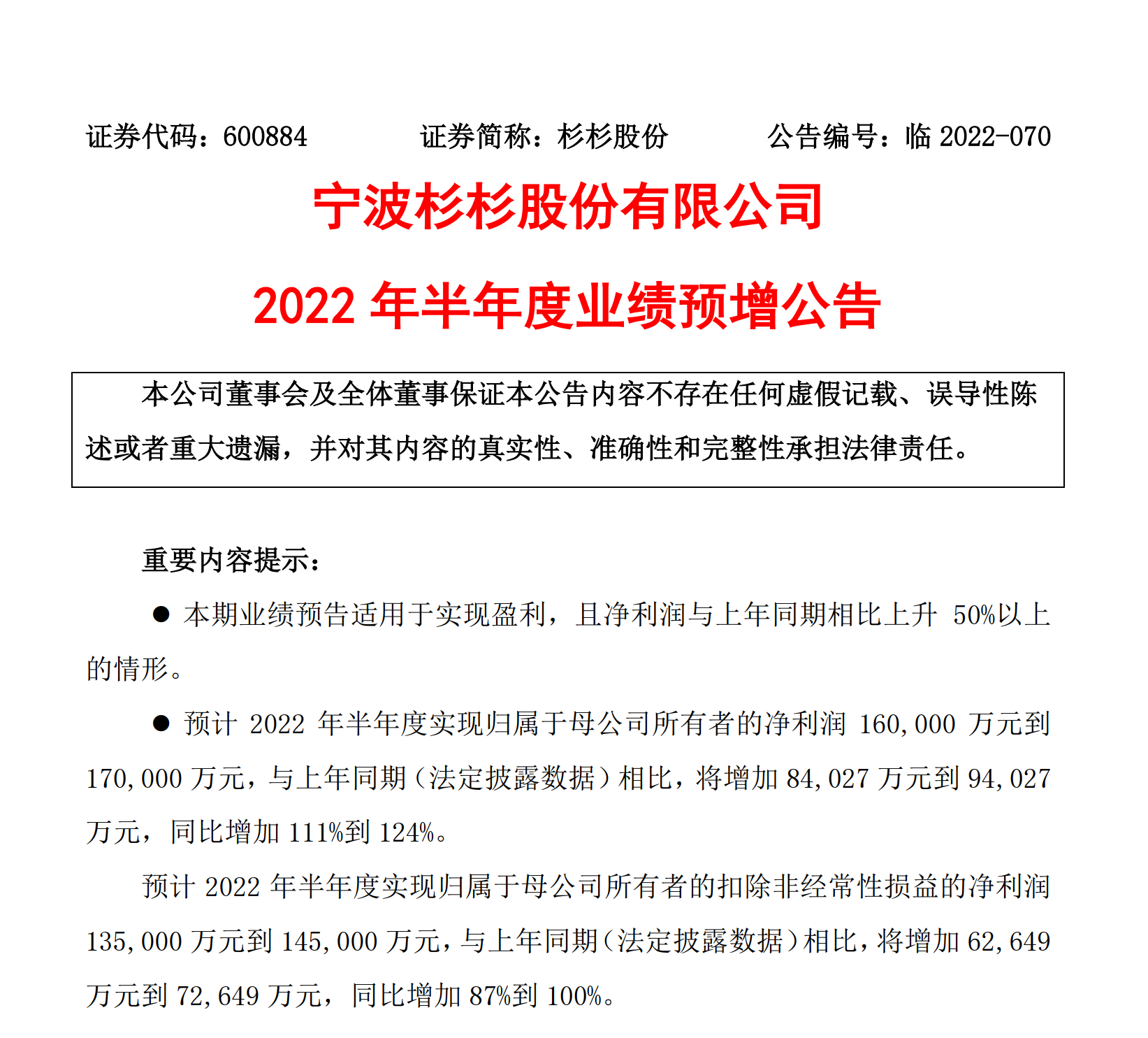

On July 13, Shanshan Co., Ltd. (SH600884, stock price of 29.45 yuan, market value of 63.6 billion yuan) released the “Announcement on Preliminary Increase in 2022 Semi-Annual Results”. Yuan to 1.7 billion yuan, an increase of 111% to 124% year-on-year.

The “Daily Economic News” reporter noticed that although the overall sales of automobiles have been sluggish this year, new energy vehicles still maintain a high degree of prosperity.

At the same time, the boom in the downstream has also brought strong investment in the upstream. Gaogong Lithium believes that according to the current plan, if the projects of various anode material suppliers reach production capacity, it will lead to overcapacity.

Benefit from the continuous boom of new energy vehicles

In response to the growth in performance, Shanshan believes that the main reason is the high prosperity of the downstream. In addition, the polarizer business has also contributed to the growth of Shanshan’s performance.

Image source: Screenshot of Shanshan’s announcement

“Benefiting from the continuous boom in the new energy vehicle industry and the strong downstream demand for anode materials business, the company continues to strengthen close cooperation with strategic customers, leading customers to accelerate the volume, superimposed the company’s Baotou Phase II new production capacity was successfully released, and the shipments of anode materials were year-on-year. During the reporting period, the price of anode raw materials rose sharply, and the company has ensured stable product unit profitability by strengthening supply chain management, continuously optimizing and upgrading product structure, and improving the level of graphitization self-supply rate. .

In 2020, Shanshan Co., Ltd. implemented a major asset restructuring of the acquisition of LG Chem’s LCD polarizer business and related assets, and completed the acquisition and delivery in February last year, incorporating related assets into the scope of consolidation. For another reason for the performance growth in the first half of this year, Shanshan said: “The company’s polarizer business continues to grow steadily and brings high performance contribution.”

In addition, the sale of 100% stake in Hunan Yongshan Lithium Industry Co., Ltd. also contributed to Shanshan shares in the first half of the year. According to Shanshan’s first quarterly report this year, its non-current assets disposal gains and losses were about 186 million yuan, mainly due to the sale of 100% equity of Hunan Yongshan Lithium Industry Co., Ltd. to obtain corresponding investment income.

But at the same time, the gains from the sale of equity interests in subsidiaries have also resulted in a relatively low growth rate of non-profit deductions for Shanshan. Shanshan expects to achieve a net profit of 1.35 billion yuan to 1.45 billion yuan attributable to owners of the parent company in the first half of 2022, an increase of 87% to 100% year-on-year.

Zheshang Securities believes that Shanshan Co., Ltd. focuses on anode materials and polarizer business, and non-core businesses such as cathode materials, photovoltaics, and energy storage are gradually divested. Polarizers are a part of the liquid crystal display industry chain with a high gross profit margin. Shanshan’s ultra-wide polarizers have strong front-end production capacity, and back-end processing bases all over the country can quickly respond to customers. Currently, the relocated production line in Guangzhou is undergoing trial production. Zhangjiagang The production line has started, which will provide support for Shanshan’s performance.

Industrial prosperity continues to accelerate production expansion

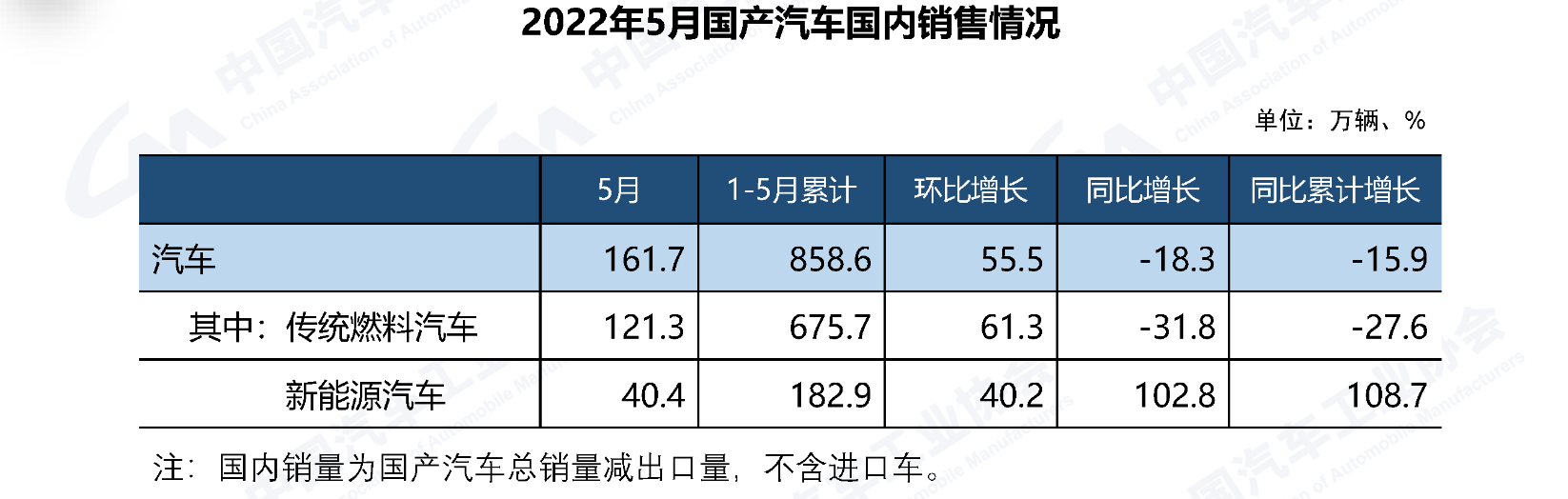

The differentiation trend of the auto industry in the first half of this year is more obvious. According to data from the China Association of Automobile Manufacturers, the cumulative sales of automobiles from January to May this year was 8.586 million, a year-on-year decrease of 15.9%. Among them, the cumulative sales of traditional fuel vehicles was 6.757 million, a year-on-year decrease of 27.6%; the cumulative sales of new energy vehicles was 1.829 million, a year-on-year increase of 108.7%.

Image source: Screenshot of the official website of China Association of Automobile Manufacturers

“The auto industry is facing the triple pressure of demand contraction, supply shock, and weakening expectations. The task of stabilizing growth is very arduous.” The China Association of Automobile Manufacturers said.

The high prosperity in the downstream led to the large-scale production in the upstream. Statistics from Gaogong Lithium Battery show that in the first half of 2022, 9 power and energy storage battery projects have been put into production, with a production capacity exceeding 118GWh; 22 projects have started construction, with a total planned capacity exceeding 638GWh; 21 signed and officially announced projects, with a total capacity plan exceeding 367GWh .

The expansion of production capacity of anode materials is also in progress. According to incomplete statistics of Gaogong Lithium, in the first half of 2022, 16 projects of anode materials were started, involving a scale of 2.276 million tons and an amount of 66.492 billion yuan.

Gaogong Lithium believes that in addition to the strong downstream demand for the intensive start of negative electrode projects, the rising price of negative electrode raw materials is also one of the reasons, and the intensive start of production also needs to be alert to the risk of overcapacity.

“The above-mentioned production capacity reached 2.276 million tons. According to the calculation of 1,300 tons of anode materials required for 1GWh, the above-mentioned production capacity can meet the battery capacity demand of about 1,750GWh. If the production capacity layout of domestic enterprises in the anode field is superimposed last year, this figure will be further enlarged. This is far more than In 2025, my country’s demand for 1.456 million tons of anode materials. When there is excess production capacity, the market will be directly reflected as the most sensitive place. In terms of price, the seller’s market will turn into the buyer’s market, and the price of anode materials will inevitably fall. “Gonggong Lithium Battery Analysis say.

At the end of June this year, Shanshan Co., Ltd. announced to the public that the total planned investment amount is about 5 billion yuan to build an integrated base project of silicon-based anode materials for lithium-ion batteries with an annual output of 40,000 tons. The project is to be constructed in two phases. The planned annual production capacity of the first phase is 10,000 tons, and the construction period is expected to be 12 months. The planned annual production capacity of the second phase is 30,000 tons. The construction period is expected to be 12 months.

Zheshang Securities believes that this planned project of Shanshan shares is the second 40,000-ton planned production capacity in China after Biteray (BJ835185, stock price 73.5 yuan, market value of 53.5 billion yuan), with a fixed investment of about 94,000 per ton. Yuan/ton, which is 3-4 times that of integrated artificial graphite. However, silicon-based anodes have the advantages of high conductivity and stability of carbon materials, and high capacity of silicon materials. It is predicted that by 2025, the global demand for silicon-based anodes will be about 370,000 tons, and there is broad room for growth.

Source of cover image: Photo by Liu Guomei of Daily Economic News