Independent Financial Advisor and Co-Founder of Affari Miei

November 9, 2023

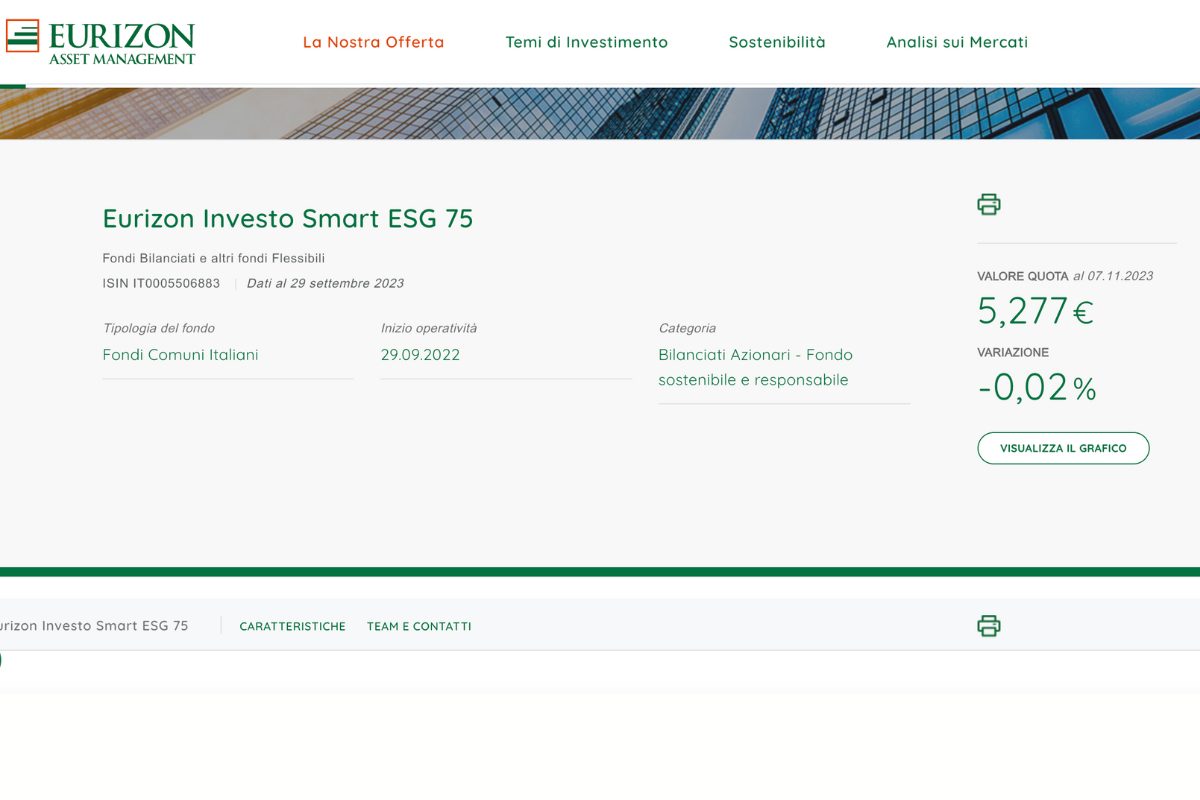

Eurizon Investment Smart ESG 75 (IT0005506883) is a mutual investment fund managed by Eurizon Capital, the arm of Intesa Sanpaolo dedicated to asset management. Having been active since September 2022, it is one of the most recent funds added to Eurizon’s offering.

If they offered you to invest in this fund, it’s a good thing that you decided to find out about it yourself. Be a conscious investor it means knowing where you’re putting your money first, and comparing multiple sources is always a great way to not be too influenced by a single rumor.

In this guide we will examine all the features of Eurizon Investo Smart ESG 75, referring to the two most important documents: the KID and the factsheet. After objectively reviewing this product, I will also provide you with an honest opinion to tell you what I think.

This article talks about:

Eurizon Capital: who manages the fund?

Eurizon Capital is one of the largest asset management companies in Europe, being the branch of Intesa Sanpaolo group which deals with the management of investment funds and services such as savings plans and other forms of managed savings. It currently manages funds for over 300 billion euros through an offering that includes hundreds of funds: in mine guide to Eurizon funds you can discover all the main ones.

The company is headquartered in Luxembourg, but the main office is that of Eurizon Capital SGR in Milan. Operations reach 25 countries currently, mainly members of the European Union as well as Hong Kong and the United Kingdom. The history of this SGR began in 1983 with Sanpaolo, and continued after the merger with Banca Intesa. Eurizon took the opportunity of the merger to strengthen itself both at a European and international level.

Characteristics of the Eurizon Investo Smart ESG 75 fund

Eurizon Investment Smart ESG 75 it is, in technical jargon, a actively managed open-end fund. Let me better introduce you to the meaning of this definition, because it brings with it some key concepts to understand the product well:

Open bottom it means that anyone can participate, and it is possible to invest and disinvest at any time;

Actively managed it means that the fund managers try to beat the reference index, actively buying and selling financial instruments to try to obtain the best possible performance.

The fund invests mainly in shares, with a smaller component dedicated to bond instruments. The bonds in the portfolio are exclusively government bonds.

Managers also try to prioritize ESG tools, i.e. investments that promote environmental and social sustainability. Having said this, there is no constraint that necessarily forces Eurizon to invest exclusively or mainly in sustainable instruments.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

What he invests in

This fund invests mainly in stocks, to which it can dedicate between 65% and 85% of the capital under management. Managers may want to invest in stocks from around the world, which involves currency risk that is partially offset by the use of derivatives to hedge this risk.

The remaining part of the funds is invested in European government bond instruments, exclusively denominated in euro, both short and long term.

The benchmark

Il benchmark of an investment fund is an index made up of different financial instruments, which forces managers to buy and sell exclusively those instruments. Since we are talking about an actively managed fund, the manager’s objective is not to obtain the same performance as the benchmark but rather try to beat him. In the case of Eurizon Investo Smart ESG 75, we are talking about a fund with different reference indices:

75% MSCI AC World in euros, an index that incorporates virtually all publicly traded companies in the world; 15% JP Morgan Emu Government Bond Index, composed of all European government bonds – minus those indexed to inflation – with a maturity exceeding 6 months; 10% Bloomberg Euro Treasury Bill, which includes all major European government bonds with a maturity of less than 12 months.

Subscription method and revenue distribution policy

To participate in the Eurizon Investo Smart ESG 75 fund, a minimum investment in units equal to or greater than is required 50 euro. It can be easily subscribed through the network of Intesa Sanpaolo consultants, through the group’s home banking services or at one of the many SIM cards affiliated with the group.

Investors have the possibility to decide whether to invest exclusively in this product or whether to make it part of a more complete service, for example a capital accumulation plan (PAC). In any case, it is important to remember that the intermediary you turn to can apply additional costs for its consultancy and/or intermediation service.

Since it is a predominantly equity fund, Eurizon recommends a minimum investment horizon of 6 years. That said, you can buy and sell shares at any time.

Cash flows from coupons, dividends and interest are not distributed to investors but are automatically reinvested within the fund.

Risk profile

Eurizon evaluates the risk of this fund with 4 is 7on a scale where 1 is the score indicating the lowest risk and 7 indicates the highest risk.

We are therefore talking about an overall risk medium-highwhich is consistent with a long-term investment strategy.

This risk profile is suitable for those seeking long-term returns and are willing to tolerate temporary losses of their capital.

Costs

Costs are an essential element to evaluate when considering investing in any financial product, which becomes even more critical in the case of mutual funds. Indeed, small percentages of commissions, on a large capital and over many years, can imply tens of thousands of euros in costs you don’t even realize you’re paying.

If this concept wasn’t entirely clear to you, in this free report you can find all the important information to understand how commissions can drastically impact your savings.

Here are the costs linked to Eurizon Investo Smart ESG 75:

1.67% for annual management fees, which are always paid regardless of the fund’s performance; 0.04% for transaction costs, which reimburse the fund for out-of-pocket costs incurred in the purchase and sale of financial instruments.

This fund has no entry or exit fees, nor performance fees. Compared to other Eurizon funds, this is certainly positive.

Historical returns

Below I show you the graph of the historical performance of the fund since its first day of trading.

From September 2022 to November 2023, the fund achieved a performance of 6.0% versus a performance of 8.7%. This is a typical element of mutual funds: statistically, over 9 out of 10 funds they do not beat the performance of the reference index either in the short or long term.

That said, it is important to note that past performance is not indicative of future performance. Furthermore, it is a fund that has only existed for a short time, so we do not yet have such a long history to be able to say that the management is not able to keep up with the benchmark.

Performance scenarios

The fund does not have a guaranteed minimum return and investors’ capital is free to fluctuate according to market fluctuations. At the same time, Eurizon provides us with an overview of how things could go based on the macroeconomic context and the performance of the financial markets.

The possible scenarios are the following:

12 month investment 6 year investment Stress -73.74% -20.60% Unfavorable -13.73% -2.43% Moderate +7.13% +6.86% Favorable +30.26% +8.84%

It should be noted that these scenarios include, but do not take into account, costs directly associated with the fund any additional costs linked to the intermediary or consultant you turn to to make the investment.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

Affari Miei’s opinions on Eurizon Investo Smart ESG 75

At Affari Miei we have always been skeptical about mutual funds in general, not just this product specifically. In the very nature of these instruments there are gods important problems linked to high costs, conflicts of interest between consultants and clients, performance almost always lower than the benchmark and poor predictability of the portfolio composition.

If you have no idea why we say this or have any doubts on the topic, download the free report to discover all the critical issues of mutual funds and how to protect your savings. Reading this report could save you tens of thousands of euros, as it has already done for many of our readers.

In our investment strategies we prefer to give priority to ETF, which are more transparent funds, listed on the stock exchange, much less expensive, free of conflicts of interest and with a more predictable composition. By replicating their benchmarks rather than trying to beat them, they also typically outperform peer mutual funds.

I many advantages looking at the numbers, ETFs make them more convenient products than mutual funds like the one we have described in this guide.

Who is fine with the fund and who isn’t

Eurizon Investment Smart ESG 75 it’s a fund suited to those who want to blindly put their capital in the hands of Eurizon’s managers, in the hope that the great freedom granted to the managers will be well placed. Also considering the rather high annual management costs, it is important for the investor to be convinced of the managers’ ability to beat the benchmark index to demonstrate that these fees have been paid for a reason.

If you have a multi-year investment horizon and you don’t have the slightest intention of taking a personal interest in your savings, then this product offers a way to delegate their management entirely. At a cost, of course.

Instead the bottom it is not suitable to who:

He wants the absolute security of investing in ESG instruments, since Eurizon has no stringent constraints on this parameter; Look for dividends and cash flows, since the fund is accumulating; It has a short-term investment horizon; He is risk averse and does not tolerate even short-term losses; He does not want to rely totally on Eurizon but prefers to have a say and autonomy in managing his own money.

Conclusions

Once again, I want to underline that you had an excellent idea if you decided to find out more about the products that your advisor has proposed to you or in which your capital is investing. Having good information is the essential starting point for being an informed investor.

If you want to go even deeper into these topics, the ideal starting point is the free report where you can find out more about mutual funds and how these products, if chosen poorly, can end up compromising the profitability of a portfolio and the growth of long-term savings.

If this is your first time visiting Affari Miei and you would like to find out more about our investment approach, you can start here.

I also leave you some guides that may be useful to you:

I hope you do the right thing for yourself, continue to follow me on Affari Miei.

Find out what kind of investor you are

I have created a short questionnaire to help you understand what type of investor you are. At the end, I will guide you towards the best contents selected based on your starting situation:

>> Get Started Now