Want to know how the trading on the online platform Trade.com? You look for opinions about the service?

With this review I answer all your questions: which markets and assets are included, how to open an account, how much does it cost to trade, what tools you can use and if the platform is legal.

Remember that this article is for information only: approach trading responsibly and with prudence!

And now let’s see the characteristics of the platform… Happy reading.

This article talks about:

What is Trade.com?

Trade.com is an online trading platform operated by Trade Capital Markets (TCM) Ltd, investment services company based in Cyprus (like many other brokers).

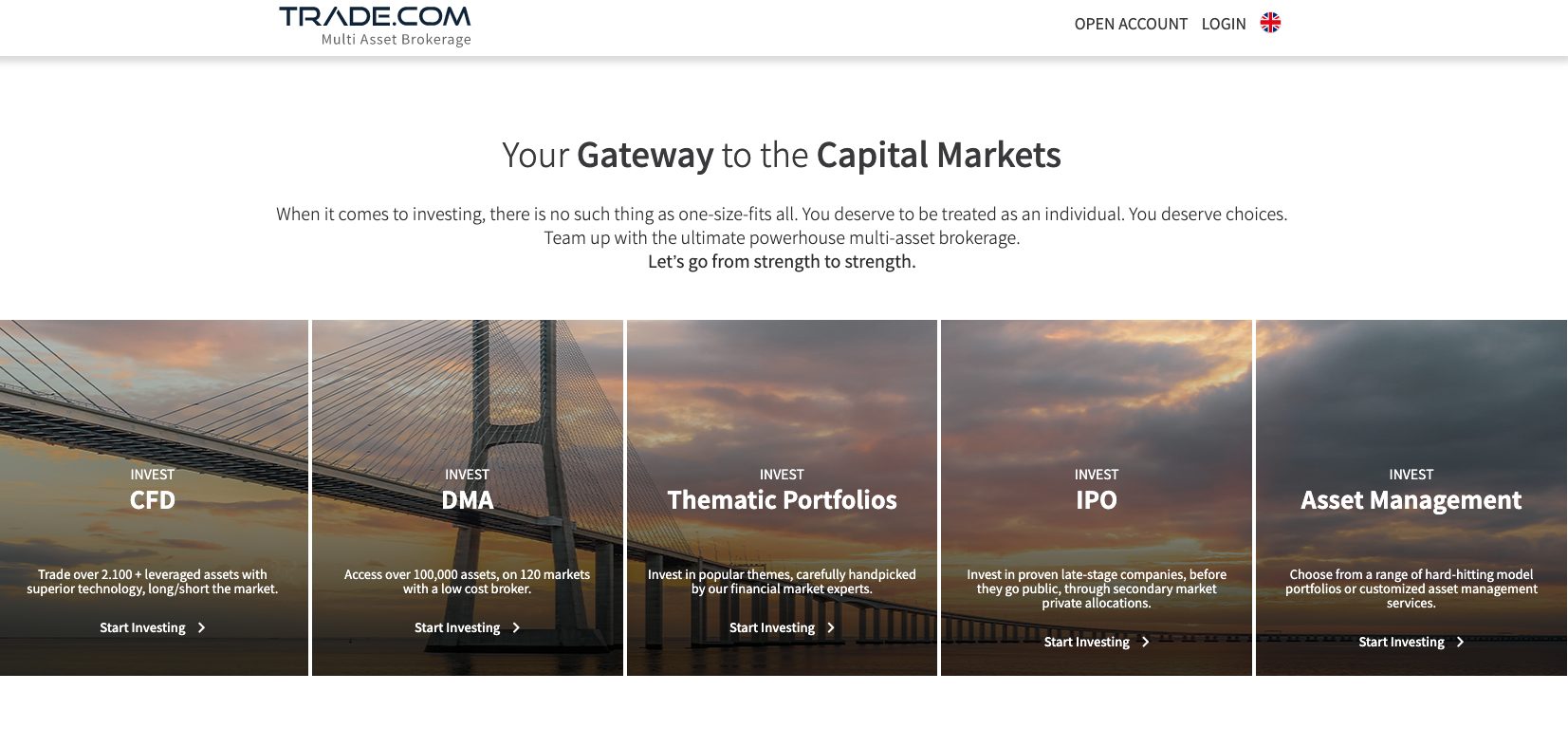

On the site it is possible to do CFD trading with numerous assets and on as many markets, by opening an account suited to your profile and being able to choose between two operating platforms for desktop computers, smartphones and tablets.

Trade.com is also broker DMA, that is, it gives direct access to the market with transparent prices. A DMA account allows you to actually trade the underlying assets: stocks, ETFs and funds, but also futures, bonds and options.

Another interesting service, available on the site, consists in the offer of thematic investment portfolios developed by the broker on the basis of the main market trends. They are pre-set stock packs but you can customize them after purchase.

Alternatively, the broker also offers a professional asset management service through the sale of portfolio master managed by qualified managers.

For those interested in the IPO market (the initial public offering market), it is also possible to open a specific account that offers a selection of investments in some of the main growing companies – some of which are already famous: Wish, Spotify, Revolut, Ripple etc.

So far I’ve outlined to you what the features are, but the service is reliable or risk the scam?

Trade.com is a regulated platform

I want to reassure you immediately, knowing full well that those approaching this world for the first time may have many doubts about it: the activity of Trade Capital Markets is perfectly link.

It is in fact regulated by CySEC (Cyprus Securities and Exchange Commission), and FCA (Financial Conduct Authority of the United Kingdom) and from FSCA (Financial Sector Conduct Authority of South Africa).

Although the broker does not have offices in Italy, it has offices throughout Europe and is equally authorized to operate in our country; it is in fact included in the Consob register of authorized investment firms.

And having made this important clarification, we can deal specifically with trading.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Tradable assets

A trader who opens an account on Trade.com can access beyond 100.000 asset. IIn particular, there is a large selection of CFD (contracts for difference) on Forex, stocks, bonds, indices, ETFs, cryptocurrencies and commodities; obviously with Financial leverage.

Stock CFDs have low spreads and zero commissions, including the most popular stocks, and have leverage up to 1:5. You are also spoiled for choice when it comes to global stock market indices, 26 covering the main economic areas.

You have more than 55 currency pairs available if you are interested in the Forex market, with 30:1 leverage for Forex major and 20:1 for non-major Forex. And if you prefer to trade on Cryptocurrency CFDs there are Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Dash and Ripple, with leverage up to 1:2.

CFD Account Types

To trade CFDs you need to open a dedicated account. There are 5 tariff plans; they start from the more “basic”, with reduced options and higher spreads, up to the more professional one which, obviously, is full of additional services and enjoys a preferential rate regime.

The account is assigned as a result of the amounts that the trader intends to move on the platform, let’s see them in detail:

- Account Micro, size $100;

- Account Silver, size $1,000;

- Account Gold, size $10,000;

- Account Platinum, size $50,000;

- Account Exclusive, size $100,000.

The platform reserves the right to change the type of customer’s account as the extent of its activity varies.

How to open an account

The procedure for opening an account is very simple and I will explain it to you immediately:

- Log in to the platform and click on “Open accounts”;

- Select the option of your interest between CFD, MDA, Thematic portfolio, Asset Management and IPO accounts. In this case let’s take the CFD account as an example;

- Once selected, a registration formfill it in by entering your email and choosing a password;

- At this point you need to do the first deposit by debit card, credit card or direct bank transfer, and any other electronic money transfer method.

In the enrollment process you will be subjected to a suitability test which is used to assess whether you are eligible for trading with derivatives and leveraged products.

You will also need to complete the verification of your identity within 15 days of the first deposit, otherwise the account will be closed and deposits returned.

Invest in ETFs

The platform also offers the possibility of invest in ETFs as CFDs. This allows you to have broad exposure to many industries, such as technology, innovation, healthcare, and large-cap companies.

But what does it mean specifically to invest in ETFs as CFDs? It specifically means that you are not buying the ETF, but rather investing in it price movements.

Trade.com allows you to trade CFDs on many popular ETFs that really cover many sectors.

You’ll be able to open trades in either direction, regardless of whether you think the price of the ETF will go up or down. Therefore, if you think the ETF price will increase, then you can place a BUY (long) position, while if you think the ETF price will fall, you can place a SELL (short) position.

Platforms for trading

As I said above, the broker provides well 2 platforms:

- WebTrader is a web-based platform developed by industry experts that offers a complete trading experience, with state-of-the-art yet easy-to-use tools – indicators, charts, up-to-date information. It is fully supported by Android and iOS systems for mobile devices;

- MetaTrader4 it is the very famous trading platform that we all know; is specialized for Forex trading but allows access, through desktop and mobile interfaces, also to other assets: CFDs, commodities, bonds, indices and shares. On this platform you can open a Demo account which works with virtual funds and is used for practice.

Costs and fees

Let’s come to another very important item to evaluate when choosing a platform: what expenses does trading on Trade.com involve?

I list them below:

- Night expensesi.e. a commission overnight o a swap fee for each position that remains open overnight;

- Conversion fees when your account currency is different from the currency of the traded asset;

- Monthly inactivity feewhen the user is inactive for more than 90 days;

- No deposit/withdrawal fees and no other charges;

- cost of spreads, it varies from asset to asset, and from account to account (for more details visit the site).

Tax management

The broker does not operate in Italy as withholding agent therefore you will have to personally take care of declare capital gains obtained through trading.

Reviews on Trade.com

By visiting the main review portals, the judgment of users is all in all positive.

Consider that we are still talking about a trading platform for which there will ALWAYS be someone who has lost money and who maybe goes to tell it around, so some negative opinion can always be there but you have to contextualize it.

As we will also see in the opinions of Affari Miei, we are facing an authorized and regular platform, so there is nothing negative to say about the medium.

Final opinions of Affari Miei on Trade.com

Is it worth trading with this platform? There is no exact answer.

Undoubtedly, Trade.com it is a qualified service. Gives access to numerous assets (including direct access to the market with the trading of instruments with real underlying) and makes use of two platforms known and very efficient. Features a Demo account to practice and offers a range of alternative investment services. AND regulated and can operate in our country legally.

My judgment itself is positive, but I stress, Trade.com is only good as long as YOU know what you are doing and how aware you are of the risks you take in trading CFDs.

There is no obligation or need to play the stock market. Trading is risky and also limited: it requires excellent preparation and, more often than not, is an end in itself. Will never replace a true investment business in the financial markets, well planned and aimed at achieving specific objectives.

Before bringing the problem of the trading platform, ask yourself the question if trading is exactly what you need and if you are able to play on the stock market without lose a lot of money! I’ll leave the assessments to you, to learn more with Trade.com

See you soon!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <