On August 2, the CSI 1000 futures index hit a new low since its listing and recorded the largest single-day drop. At the same time, the single-day decline of the CSI 1000 index in the spot market also ranks among the top among all broad-based indices.

The industry is concerned about the impact on the spot price trend after the opening of its derivatives trading. However, judging from the situation that the four major contracts are now lower than the spot price and all have increased positions, there are obvious differences between the long and short positions in the market, and the superimposed leverage is used to hedge the falling spot price. risks still exist.

The 4 major contracts below the spot price are all now Masukan

Different from the previous structural adjustment of the disk, on August 2, the major broad-based indexes of A shares all experienced a large decline, and the market generally believed that it was disturbed by external factors; however, A shares had also experienced similar “noise” before, and the interference was limited. , whether this adjustment will open the curtain of callback has also attracted the attention of the industry.

Insiders said that although the disk showed a collective pullback, the scale of the small and medium-sized market pullback was more obvious. Wind statistics show that the recent trading volume of CSI 1000 has increased, with a drop of more than 3.10% throughout the day, ranking second among all broad-based indices. After the opening of the CSI 1000 stock index futures option trading on the 22nd of last month, the outside world was once optimistic about the next gold-absorbing strength of this index-based investment tool.

However, some people from the Shanghai investment community communicated with a reporter from the “Daily Economic News” on WeChat on August 2, saying that although derivatives such as options have been launched, they are not easy to operate in China. “Judging from the current trading situation on the futures exchange, the industry is quite divided on the future performance of the spot (CSI 1000) market.”

The main futures IM2208 trend today source: Wind screenshot

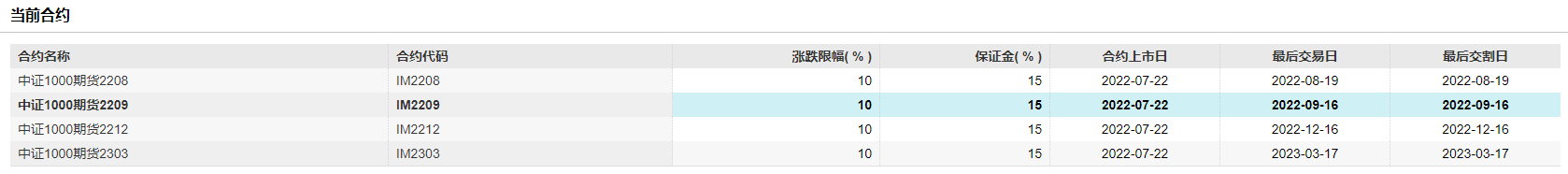

Reflected in the net amount of Masukura traded on the floor, it can be seen that the current prices of the four major contracts under the CSI 1000 stock index futures are all lower than the spot price. As of the close on August 2, the CSI 1000 Index closed at 6957.98 points, and among the four major futures contracts, the main contract IM2208 reported 6948.2 points that day, down 2.55%, and Masukura 7620 lots, the most among all contracts.

The remaining contracts IM2209, IM2212 and IM2303 have 3660 lots, 1063 lots and 208 lots respectively, of which IM2303 is a forward delivery contract. The last trading day is March 17, 2023, and the current point is still at 6612.0. The above-mentioned people in the investment community admitted that the contract increase obviously reflects the coexistence of long and short positions. At present, it is not yet possible to determine whether there is a strong willingness to short the 1000 stock index futures. However, with the enlargement of the trading volume, the recent delivery contract price has obviously converged with the spot price.

He pointed out that if the price of the longer-term contract is lower than the spot market price, it means that the market believes that the future stock price is in a downward trend. Look, he believes that unless the judgment on the market trend is highly consistent, most institutions will implement a hedging strategy based on futures tools to hedge against the risk of falling spot prices.

The profit and loss of investment in 4 major futures contracts can be magnified up to 7 times

In fact, the CSI 1000 index fell today and has hit the largest value since the opening of its stock index futures options trading. If institutions want to use the derivatives trading mechanism to hedge against the risk of falling spot prices, they need to short warrant 1000 futures to lock in the future price risk.

Different from the horizontal disposal of the traditional long-short strategy, the short futures hedging strategy is more flexible in terms of futures, and from the current margin agreement of the four major contracts, Wind statistics show that the current margin ratio of IM2208, IM2209, IM2212 and IM2303 Both are set at 15%, and the profit and loss can be enlarged up to 7 times.

Current contract margin and related introduction source: Wind screenshot

According to the above-mentioned people in the investment community, after calculating the size of the spot position, the institution will use the same amount of futures to add margin and sell it. After the expiration, the spot and futures prices will converge. “If the futures income is roughly equivalent to the spot loss, then the hedging strategy At the same time, institutions can add several times the cost of the current margin to cover, and the futures income will be amplified by the same multiple.”

Of course, the risk of the same amount of hedging strategy is relatively controllable, but with leverage intervention, when the futures shorting fails and the profit from the spot stock is not enough to make up for the loss of shorting the futures, a huge loss will be formed. The person admitted that for institutional investors, similar operations need to be supported by very strong models and computing power, otherwise the strategy will fail.

According to the standard contract, the delivery month of the contract is the current month, the next month and the following two quarters. According to the latest contract delivery period, the final delivery date of IM2208 is August 19 this year, although from the perspective of Masukura, there are still investment However, as the delivery date approaches, there may be differences in the willingness of institutions to passively allocate cash.

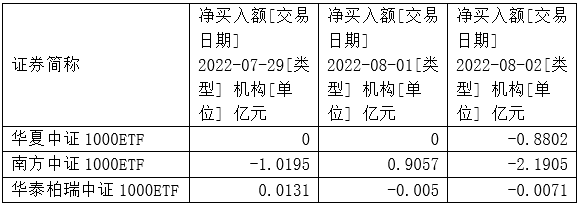

Source of recent capital flows of some CSI 1000 ETFs: Wind statistics

Taking public offering-related ETFs as an example, Wind statistics show that as of August 2, among the 7 CSI 1000 ETFs in the market, there are CSI 1000 ETFs under Hua Xia, Nanfang, and Huatai-Pine Rui that have daily net inflow statistics. All showed a net outflow of funds, and the absolute value was significantly larger than that of the previous two trading days.

Some public offerings look forward to rebound recovery after emotional digestion

It can be seen that the broad-based index tools of small and medium-sized caps and the allocation value of stocks with small and medium-sized market caps in the future are also divergent. In particular, the broad-based index represented by CSI 1000 has the highest decline in all indices, and it is also concerned by the market. configuration value and opportunities.

The analysis of Hang Seng Qianhai Fund pointed out that due to the impact of foreign events, the market experienced a relatively large correction, and the index fell below the support of the 60-day line. assets to hedge against uncertainty risks.

In his comments on today’s market changes, he pointed out that on the whole, it is still an adjustment driven by events and emotions. Under the situation that the domestic growth stabilization policy continues to exert force and the domestic liquidity environment is still relatively loose, it is expected that short-term disturbances may not change the economy. The general trend of recovery, after the market sentiment is further digested, the market may recover from oversold and rebound.

From a long-term perspective, the mid-to-long-term positive trend of A-shares will remain unchanged, and real estate-related risks will be focused on and dealt with. From the current point of view, economic growth will recover to a certain extent in the second half of the year, risk factors are expected to be controllable, and there is room for A-shares to grow upwards. will open.

From the perspective of industry development, the high-end manufacturing industries dominated by new energy and semiconductors will become an important pillar of my country’s economic growth in the future. The prospects for industrial upgrading and domestic substitution are good. In the long run, these industries still have great development. space. Therefore, in the medium and long term, we continue to be optimistic about the domestic high-end manufacturing industry chain dominated by new energy and semiconductors, and at the same time, we are also optimistic about consumption, medicine and other industries with room for bottom and bottom under valuation.

In addition, for the military industry sector that has performed well today, Weng Yuping, manager of Great Wall Jiuyuan Fund, said that fundamentals are the dominant factor driving the market price of the sector. I haven’t seen that if the market adjusts as a whole again, it may suppress the valuation of the military sector.

Source of cover image: Photo Network-401696359