Apple today released a savings account (savings account) in the United States that will yield 4.15% per year — 10x more than the average rate for savings accounts at commercial banks in the country.

The launch puts Apple in direct competition with the big American banks – and at a time when there is a real war for deposits in the US.

With interest rates rising from zero to the 4.75% to 5% range, commercial banks such as JP Morgan and Citi are under heavy pressure to raise their savings accounts. Not changing the rate can lead to the loss of customers; increasing it leads to loss of profitability.

Over the last year, Americans have already withdrawn more than US$ 800 billion in deposits from commercial banks to invest in more profitable products.

In the US, the average rate of savings accounts is a measly 0.37% per year, according to Federal Deposit Insurance Corporation, which guarantees bank deposits.

Some players already offer better remuneration, but the rate paid by Apple will be one of the highest on the market.

To give you an idea: Marcus, Goldman’s digital account, pays 3.9% per year to its users, while American Express pays 3.75% and Capital One, 3.5%.

Given the aggressiveness of the rate, some analysts speculate that Apple is subsidizing the product as a way to further retain iPhone users – the main users of the Apple Card.

The Apple account was launched in partnership with Goldman — the issuing bank — and is exclusive to Apple Card customers, also operated by Goldman.

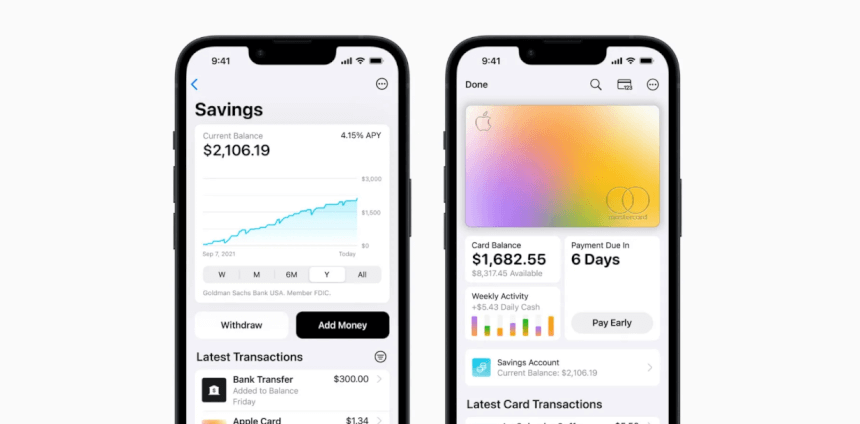

These customers will have access to the Wallet account on the iPhone, where there will be a dashboard showing the total invested and the yield in a given period. Another product differential is that customers will be able to apply their Daily Cash rewards (the Apple Card benefits program that gives 3% cashback on card purchases) directly to this account.

There will be no minimum deposit or fee for the use of the account, but each client can leave a maximum of US$ 250,000 invested.

The launch is Apple’s boldest bet in the financial segment. The company has offered its Apple Card since 2019 and, in March last year, launched its ‘buy now pay later’ solution that allows customers to divide purchases made on the card into four monthly installments.

Unlike the card and savings account, ‘buy now pay later’ is not operated by Goldman, but by Apple’s own financial services division, Apple Financing.

Peter Arbex