Shanghai and Shenzhen:In the first week after the Dragon Boat Festival, A shares closed down across the board. This weekShanghai Index, Shenzhen Component Index, and ChiNext fell 1.8%, 1.47%, and 1.80% respectively. ChiNext’s weekly gains stopped for five consecutive years and still stood above the 5-week moving average. The Shanghai Stock Exchange fell below the 5-week moving average for three consecutive days. Once fell below the 10-week and 20-week moving averages, the turnover of the two cities was 3.834.868 billion yuan (four trading days) compared with the five trading days before the holiday last week, a slight decrease of 2.94% year-on-year. A-shares continue to structure the local market, light index and heavy individual stocks, and need to control positions when the direction is unclear. The current market revolves aroundPerformanceThe two main lines of the interim report and the interim report are launched, focusing on the sectors where the interim report performance is expected to continue high growth or exceed expectations. From the perspective of thematic investment, technology growth such as semiconductors, new energy vehicles, new energy and other sectors have already wonMain forceInstitutions are chasing hype, and investors can make a mid-line layout on dips.

weekendMajor financial news

1. The National Standing Committee: Determine the policy for accelerating the development of affordable rental housing

Li Keqiang presided over an executive meeting of the State Council to determine the policy of accelerating the development of affordable rental housing and alleviating the housing difficulties of groups such as new citizens and young people. In order to guarantee the basic housing needs of new citizens and young people in the process of urbanization, the meeting decided to implement the main responsibility of the city government, encourage the participation of market forces, and increase the supply of small-sized affordable rental housing with rents below the market level.populationNet inflowIn large cities, such as collectively-owned construction land, enterprises and institutions’ own land for construction, or use of idle commercial and office buildings, etc., can be used to rebuild affordable rental housing. From October 1st, leasing companies will pay a 1.5% reduction in value-added tax for rented houses to individuals, and enterprises and institutions will levy real estate tax at a reduction of 4% for renting houses to individuals and large-scale leasing companies.

2. The central bank in charge of newspapers: unfounded so-called liquidity forecasts can be stopped

The Central Bank’s “Financial Times” commented that in early May this year, some market analysts believed that due to the traditional corporate income tax settlement and payment time in May, fiscal deposits would rise sharply, adding factors such as increased local bond issuance. , Market liquidity may tighten on the margins and lead tointerest rateIncreased volatility. Many financial market experts refuted this view, believing that there will be no significant fluctuations in liquidity in May. Looking back now, it is indeed unnecessary to worry about the tightening of funds in May.

3. Over 1 billion doses of new crown vaccination nationwide

The National Health Commission notified that as of June 19, 2021, 31 provinces (autonomous regions and municipalities) and the Xinjiang Production and Construction Corps had reported a total of 1,104.489 million doses of new crown virus vaccine.

4. Release of the “White Paper on Hainan Free Trade Port Construction (2021)”

On the morning of June 20, the “White Paper on Hainan Free Trade Port Construction (2021)” was officially released.According to Wang Lei, Deputy Secretary-General of the Hainan Provincial Party Committee and Executive Deputy Director of the Provincial Party Committee’s Deep Reform Office (Office of the Free Trade Port Working Committee), the white paper focuses on trade freedom and convenience, investment freedom and convenience, and cross-borderCash flowEleven aspects such as freedom of movement and convenience, freedom and convenience of personnel entry and exit, free and convenient transportation, safe and orderly flow of data, modern industrial system, taxation system, social governance, rule of law construction, risk prevention and control, etc. describe the overall construction of the Hainan Free Trade Port. The implementation of relevant policies and systems identified in the Plan. (New Hainan)

5. Huawei Supply Chain Company: Huawei Mate50 mobile phone design plan has been received and the delivery time is to be determined

It is learned from Huawei Supply Chain Company that the company has received Huawei Mate50 mobile phone design proposal. A source at Huawei Supply Chain said, “Huawei has not said that it will cancel the release, but the time for mass production and supply has not yet been determined.” (China Securities Journal)

6. China Automobile Association: It is estimated that the domestic passenger vehicle growth rate will be about 10% this year, and the sales of new energy vehicles will exceed 2 million.

Xu Haidong, deputy chief engineer of the China Automobile Association, said at the 2021 China Automobile Forum that after adjustment, the overall growth rate of the domestic automobile market this year will be adjusted to 6.5% from the previous 4%. Among them, passenger vehicles may increase by about 10%, while commercial vehicles will be adjusted from the original -10% to -8%. The entire new energy vehicle will exceed 2 million units, an increase of 46%.

7、Ningde eraDenying mandatory employee purchasesTesla:No quality problem, no mandatory purchase

A few days ago, the Internet broke the news that starting from March,Ningde eraHe ordered the mandatory manager-level employees to purchase Model 3, and said that the mandatory employees to purchase these models were due to battery problems.TeslaReturn toNingde eraof.In response, the relevant person in charge of the Ningde Times responded to the Beijing NewsshellThe financial reporter said, “About employee purchasesTeslaIt is the company that promotes full electrification and encourages employees to purchase electric vehicles at preferential prices, not limited to Tesla, including most of the brands we supply. “The person in charge also emphasized, “(This batch of cars) has no quality problems, and there is no compulsory purchase. “The person in charge said that in order to promote full electrification, the company encourages employees to buy electric vehicles at preferential prices. This activity has been going on for three years and is held at irregular times each year. Last year was during the National Day.shellFinance)

8. The China Securities Regulatory Commission issued the IPO approval documents for 2 companies. A total of 12 companies were approved.

The China Securities Regulatory Commission approved the initial applications of the following companies in accordance with legal procedures: Shanghai Rural CommercialbankCo., Ltd., Zhejiang Yonghe Refrigeration Co., Ltd. The Securities Regulatory Commission also issued approvals for the Science and Technology Innovation Board and the ChiNext this week, and the number of approved companies was 5. So far, a total of 12 companies have obtained IPO approvals this week.

Trader Raiders next week

One,Hot spot forward

9 public offering REITs will be listed next Monday

The first batch of 9 infrastructure public offering REITs on the Shanghai Stock Exchange and the Shenzhen Stock Exchange will be officially listed on June 21 (next Monday), which indicates that the pilot work of domestic public offering REITs is about to officially land. The first batch of 5 infrastructure public offering REITs on the Shanghai Stock Exchange are GLP (508056), Soochow Suyuan (508027), Zhangjiang REIT (508000), Zhejiang Hanghui (508001), and Capital Water (508006). The first batch of 4 publicly offered infrastructure REITs on the Shenzhen Stock Exchange are Shougang Green Energy (180801), Shekou Industrial Park (180101), Guangzhou Guanghe (180201) and Yangang REIT (180301).

The first batch of double innovation 50ETFready

The first batch of 50 ETFs for technology innovation and entrepreneurship that have attracted much market attention will be officially launched next Monday (June 21), and 9 of the first batches have been approved.fund companyHave announced the share saleannouncement.Although they are all released on June 21st, but thesefundThe period of sale varies. The 50 ETF products of several companies such as Nanfang, Harvest, and China Merchants only sell for a day on the 21st, while the fundraising period for the other companies is from June 21 to June 23. In addition, many companies have set a raise limit of 3 billion yuan for this product. According to the announcement, under normal circumstances, investors can subscribe by choosing three methods: online cash, offline cash and offline stocks.

Financial managementProduct sales management measures will be implemented

The “Interim Measures for the Administration of the Sales of Wealth Management Products of Wealth Management Companies” formulated by the China Banking and Insurance Regulatory Commission will come into effect on June 27, 2021. The main content of the “Measures” includes clarifying the scope of sales agencies of wealth management products, clarifying the responsibilities of product issuers and sellers, etc. The “Measures” clearly prohibits the use of absolute values or interval values to display performance comparison benchmarks alone or prominently, to prevent disguised publicity of the expected rate of return.

two,IPO calendar

Next week, there will be 12IPO subscription, Including 4 on Monday and 5 on Thursday.Weigao OrthopedicsThe main business is the R&D, production and sales of orthopedic medical devices, with an issue price-earnings ratio of 26.88;Inno LaserThe main business is the research and development, production, sales, service and software product development of laser and intelligent control technology system solutions and related products;Golden House Energy SavingThe main business of the company is heating operation services, energy-saving renovation services and the research and development, production and sales of energy-saving products.

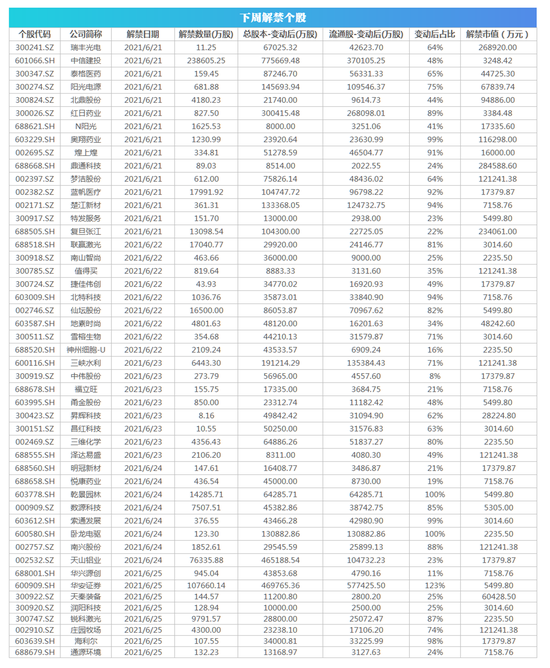

three,Restricted sharesLift the ban

A total of 48 companies’ restricted shares will be lifted next week, with a total of 5.62 billion shares lifted. Based on the closing price on June 18, the market value of the lifted ban will be approximately 22.2 billion.

(Source: Investor Network)

.