Vivendi: Tim has to ratify the assembly on the network

Vivendi, Tim’s main shareholder, intervenes with a straight leg on the game for the future of the network that was starting to heat up in recent days. The French have in fact written to Tim’s board of directors to remind them of the weight of their 23.75% on the fate of the network. For Vivendi, any decision will be made by the board of directors on the sale of the network it must then be ratified by the extraordinary shareholders’ meeting.

According to what appears to Truth&Business, Vivendi does not consider the offers satisfactory, based on the details in the press. So much so that, within the letter, he would have invited the board of directors to evaluate alternative solutions to the two offers. The hope of the French, also given the good relations with the government, would be to reach a positive conclusion in the short term.

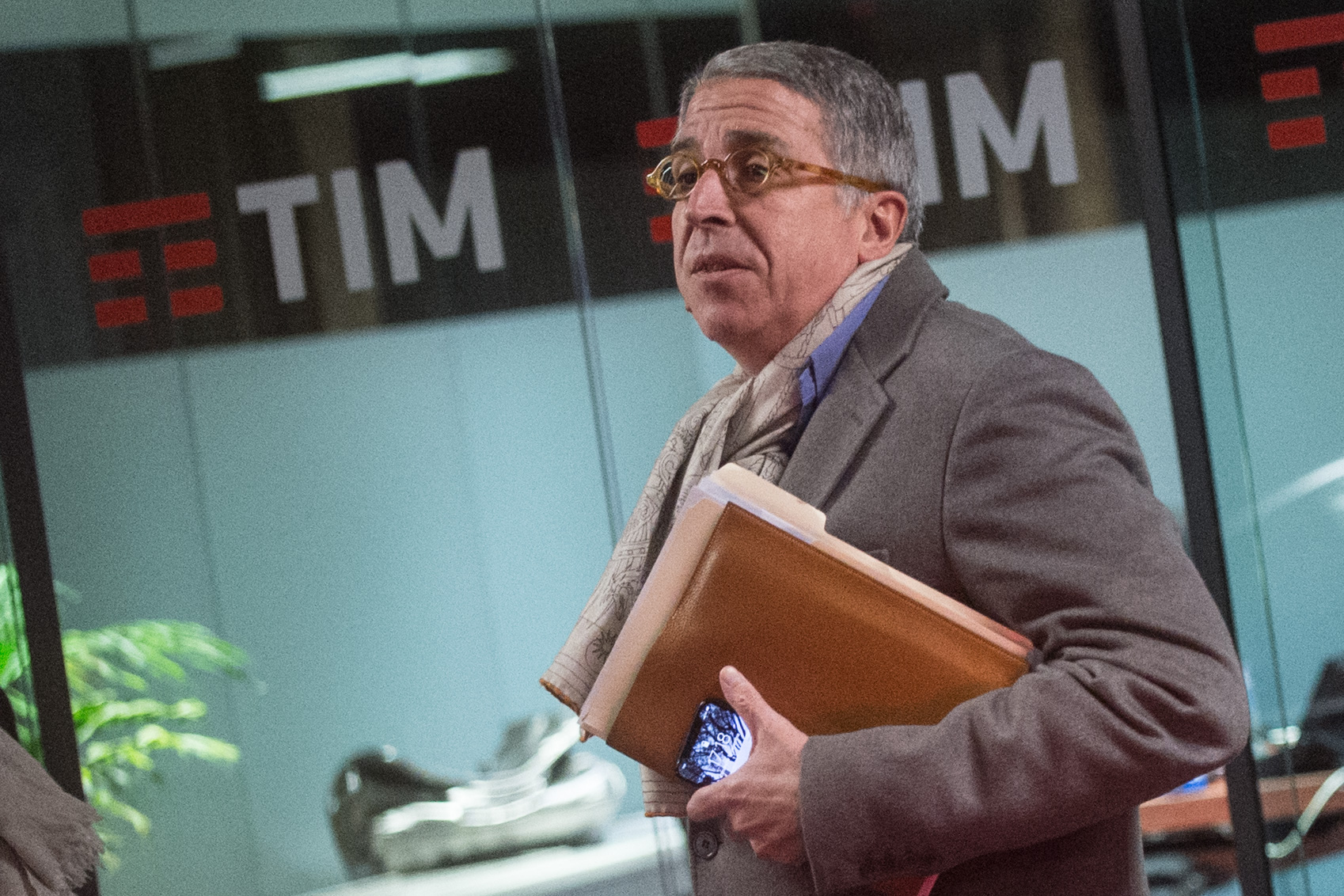

The letter arrives the day before the expiry of the deadlines for modifying the agenda of the meeting on the 20th. Therefore, the voices that wanted the first shareholder ready to make a move to discourage the current board of directors lose weight where after the resignation of Arnaud De Puyfontaine arrived in mid-January has no more representatives.

Vivendi would also have brought out another node: the fate of ServCo without Netco. Any offer for the network will have to ensure that the activities that will remain with Tim are sustainable in order to be accepted.

Improved offers

In recent days there has been much talk of a possible increase in the offer of CDP for Tim, so much so that the stock on the Stock Exchange has risen up to 30 cents. Vivendi’s letter could dampen these enthusiasms because it would reaffirm the firm position of the French, who value the network at over 30 billion euros, while the first proposals to arrive would be around 18 billion euros.

The US fund Kkr and the consortium composed of Cdp e Macquarie they are competing for Telecom Italia’s fixed network and are studying the dossier to evaluate improvements to their initial proposals. The deadline for new proposals has been set at April 18th.

Salvini with Cdp-Macquarie

Meanwhile, the Minister of Infrastructure and leader of the League also hinted at the future of the Tim network Matthew Salvini, albeit in a personal capacity, on the occasion of a question time in the Chamber. For Salvini, the proposal of the Cdp-Macquarie tandem would be better because it is “predominantly industrial in content”.

“My personal opinion is that, whether they are airports, roads, motorways, railways or telecommunications, I always and in any case prefer an industrial plan to a mere financial plan that will cash in in the short term: here we need a person who in the medium-long term invest in the infrastructure and network of this country,” said Salvini. “Since it is a listed company – he specified – the Government is following developments with the utmost attention in respect of Tim’s full autonomy” but “the Government’s interest remains in maintaining strategic control of the network, possibly moving from the old copper to the modern fiber. The challenge of the future – Salvini underlined – also passes through new infrastructures, including digital and intangible ones on which we are working at all levels and which with the new contract code will bring innovation in the management of tenders and construction sites throughout Italy ” .