To have a “decent” pension, hundreds of thousands of young people who are under 35 today will have to work on average until they turn 74. And for… Already a subscriber? Login here!

SPECIAL OFFER

BEST OFFER

ANNUAL

79,99€

19€

For 1 year

CHOOSE NOW

MONTHLY

6,99€

€1 PER MONTH

For 6 months

CHOOSE NOW

SPECIAL OFFER

SPECIAL OFFER

MONTHLY

6,99€

€1 PER MONTH

For 6 months

CHOOSE NOW

– or –

Subscribe by paying with Google

Subscribe

SPECIAL OFFER

Read the article and the entire website ilmessaggero.it

1 Year for €9.99 €89.99

Subscribe with Google

or

€1 per month for 6 months

Automatic Renewal. Turn off whenever you want.

Unlimited access to articles on the site and app The Good Morning newsletter at 7:30 The 18 o’clock newsletter for updates of the day The podcasts of our signatures In-depth analysis and live updates

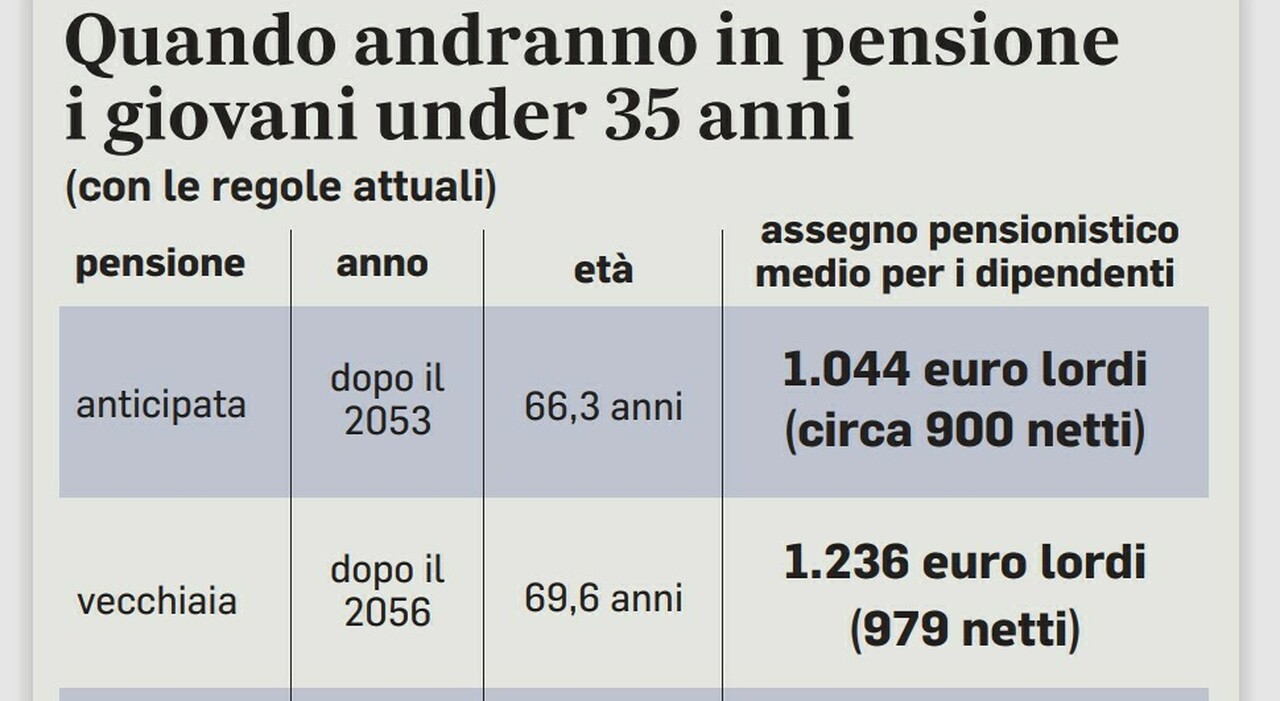

To have a “decent” pension, hundreds of thousands of young people who are under 35 today will have to work on average until they turn 74. And by dignified we mean just over a thousand euros a month. This is the most alarming data that emerges from the research “Contributory situation and pension future of young people”, carried out by the National Youth Council together with Eures. But the other figures also make us think, showing that in the next few years we risk the explosion of a social bomb. “The combination of job discontinuity and low wages for workers under 35 – explains the Prime Minister, Maria Cristina Pisani – will determine a retirement from work only for old age, with pension amounts close to that of a social allowance”. A situation that will be “socially unsustainable”, for which there is the “need for a more in-depth debate on social security issues, which takes into account the needs of young people”.

Pensions, projections

With the current rules, the pension projections of the 3.2 million young people enrolled in the employee pension fund, especially considering those who are poorer, are clear. The under 35s could in theory leave their jobs after 2050, i.e. at the age of 66.3, but the average check would be 1,044 euros gross (about 900 net). This is just double the social allowance, given to those who are practically incompetent. But to really retire you need to have accrued a check that is 2.8 times higher than the minimum. Therefore, it would be necessary to wait an average of 69.6 years and the amount of the allowance would reach, again on average, 1,249 euros (951 euros per month net of Irpef). To have a decent income, of 1,577 euros (1,099 net of Irpef), therefore a deferred exit would be needed for 73.6 years, or after more than 52 years of permanence – largely discontinuous – in the labor market.

For workers with a VAT number (always staying at least until 2057 and retiring at 73.6 years) the amount of the pension allowance would be on average 1,650 euros gross per month (1,128 net of Irpef), a value which is equivalent to 3.3 times the social allowance. For them, the first useful retirement window would open around the age of 69 and would provide for a pension allowance of 1,055 euros, which corresponds to 806 euros net of personal income tax.

The correctives

According to Alessandro Fortuna, councilor of the presidency of the CNG with responsibility for social security policies, “the estimates highlight the serious distortion of the pension system, which not only projects income inequalities over time, renouncing redistribution, but is even punitive towards workers with higher incomes low, forced to remain in the labor market (beyond the contribution seniority) for three or even six years longer than their peers with higher incomes and with greater job stability».

The government is aware of the emergency, but has not yet implemented any corrective measures. The interventions could come from the next budget law. The idea is to establish forms of guarantee for public welfare. But also act on the redemption of the degree. If there is money, the cost of the subsidized one for the under 35s could be lowered. Today, each year redeemed costs 5,776 euros. So we shouldn’t exactly arrive at a minimum guarantee pension for everyone (the unions are asking for it to be at least 600-650 euros for each and every one), but aid would be guaranteed to increase the allowance, not burdening the state coffers too much . We are therefore working with the tax reform, to be completed within two years, with additional relief and deductions for supplementary pensions, facilitating access to pension funds. A first move already discussed is a 100% one-year relief from the payment of contributions to promote the employment of the under 30s in financial consultancy. Primarily involved would be Enasarco, a supplementary pension institution to which commercial agents are obliged to pay contributions on commissions. All these interventions, however, could only slightly increase the average pensions of young people. Read the full article

on The Messenger