Original title: Guangzhou Housing Provident Fund loan policy has changed, these circumstances will not give loans… Shenzhen will also have new changes

Summary

[Guangzhou Housing Provident Fund loan policy has changed. These circumstances will not give loans and Shenzhen will also have new changes]The maximum term of second-hand housing loans in Guangzhou has been extended! On June 8, the Guangzhou Housing Provident Fund Management Center initiated a new version of the “Guangzhou Housing Provident Fund Personal Housing Loan Implementation Measures.” The new policy further supports the introduction of talents, increases the number of non-loan situations, and extends the maximum period of second-hand housing loans. Experts pointed out that the new Guangzhou provident fund loan policy has not only increased convenience, guaranteed rigid demand and reasonable housing demand, but also done risk prevention work. (Broker China)

The maximum term of Guangzhou second-hand housing loans has been extended!

On June 8, the Guangzhou Housing Provident Fund Management Center initiated a new version of the “Guangzhou Housing Provident Fund Individual Housing Loan Implementation Measures” (hereinafter referred to as the “new “Implementation Measures”). The New Deal further supports the introduction of talents, increases the number of non-credits, and extends The maximum term of second-hand housing loans has been extended.

Experts pointed out that the new Guangzhou provident fund loan policy has not only increased convenience, guaranteed rigid demand and reasonable housing demand, but also done risk prevention work. It is expected that the revision work similar to Guangzhou will increase in various places, and promote the organic link between the provident fund loan policy and the housing market reform policy.

Guangzhou releases new version of housing provident fund personal home purchase loan

The Guangzhou Housing Provident Fund Management Center pointed out that in recent years, the state, provinces, and cities have introduced a series of housing provident fund loan policies. The original “Guangzhou Housing Provident Fund Implementation Measures for Individual House Purchase Loans” (hereinafter referred to as the “original “Implementation Measures”) have already been adopted. Not adapt to the new situation and new requirements. In order to prevent loan risks, improve the public service level of our city’s housing provident fund, and at the same time facilitate the depositing staff to fully grasp and understand our city’s housing provident fund loan policy, our center is based on the positioning of “persisting that the house is used for living, not for speculation”. Combining the opinions of relevant units and the public, the current main provisions on housing provident fund loans are integrated and revised to form a new “Implementation Measures.”

Compared with the current housing provident fund loan policy in Guangzhou, the new “Implementation Measures” has four main changes:

1. Support the introduction of talents. Under the premise of meeting Guangzhou’s talent purchase policy, increase the number of employees who hold a talent green card vice certificate or district talent green card to apply for housing provident fund loans, and enjoy the benefits of this city’s household registration deposit employees.

2. Increase the provision of prioritizing the provision of housing provident fund loans for demobilized military personnel.

3. Increasing the situation of not granting loans to prevent loan risks. Including: the purpose of the house is a villa, the house is an independent house, and only part of the property rights of the house is purchased (except for shared property houses).

4. Refer to other provident fund centers and businesses for the longest term of second-hand housing loansbankIt is stipulated that from 20 years to 30 years, the age of the building plus the loan period is adjusted from no more than 40 years to 50 years.

Yan Yuejin, Research Director of Think Tank Center of E-House Research Institute, toldBrokerageChinese reporter, the provident fund loan policy is actually two lines, the first is to increase the degree of convenience, as far as possible to ensure rigid demand and reasonable housing demand. This time Guangzhou also mentioned the relevant treatment for relevant talents to deposit and use the provident fund, which will help protect the rights and interests of home buyers. The second is to restrict some loans, not only to prevent liquidity risks, but also to combat all kinds of demand for real estate speculation. Judging from the actual process, the provident fund loans for some villas and other projects should indeed not be issued, which violates the direction of the provident fund.

Note: The loanable amount of provident fund must meet four requirements

The new “Implementation Measures” clarify that the loanable amount of individual housing provident fund shall meet the following requirements at the same time:

(1) Not higher than the provident fund deposit account balance × 8 + monthly deposit amount × the number of months to retirement age.

(2) Not higher than the maximum loan amount of housing provident fund in our city. The maximum amount will be issued and implemented by the Municipal Housing Provident Fund Management Committee based on the city’s social and economic development.

(3) Not higher than the total purchase price × (1-minimum down payment ratio).If the house purchased is a first-hand house, the total purchase price shall be signed on the house sale websitecontractThe price shall prevail; if the house purchased is a stock house (second-hand house), the total purchase price of the shared property house shall be subject to the total purchase price agreed in the house purchase and sale contract, and the total purchase price of other houses shall be based on the contract price of the house purchase network. The lower of the house inspection (assessment) price shall prevail.

(4) The monthly housing provident fund loan repayment calculated based on the loan amount shall not exceed 50% of the applicant’s family income. The income of paid employees shall be determined according to the following criteria: if the housing provident fund payment base does not reach the upper limit of the city’s current payment base, their personal income shall be subject to the payment base; if the payment base reaches the upper limit, their personal income shall be based on their payment base The higher value between the wage and the wage shall prevail, and the wage shall be determined by the amount registered by the employee in the provident fund center.

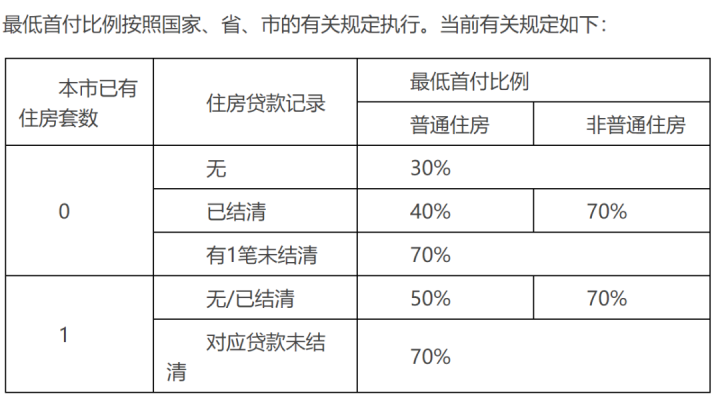

In addition, Guangzhou Housing Provident Fund Management Center summarized the minimum down payment ratio when applying for housing provident fund loans:

Shenzhen initiates preparations for the revision of “Provisions on the Management of Housing Provident Fund Loans”

It is worth noting that after Guangzhou issued the new version of the “Guangzhou Housing Provident Fund Personal Housing Loan Implementation Measures,” Shenzhen also released the news that it would start the preparations for the revision of the “Housing Provident Fund Loan Management Regulations” on the same day.

It is reported that the “Shenzhen Housing Provident Fund Loan Management Regulations” will expire in September 2022, and preparations for revision are now initiated. The Shenzhen Housing Provident Fund Management Center adopted the public bidding method to implement procurement on the subject of “Research on Optimizing and Perfecting the “Shenzhen Housing Provident Fund Loan Management Regulations””.Will be combined with Shenzhenreal estateMarket characteristics, economic development level and housing loan demand, etc., comprehensively analyze the implementation of the housing provident fund loan system in Shenzhen; combine the reform direction of the national housing provident fund system, and propose specific optimization plans for building a housing provident fund loan system that is more in line with the reality of Shenzhen And perfect path.

Wang Menghui, Secretary of the Party Leadership Group and Minister of the Ministry of Housing and Urban-Rural Development, once pointed out that the housing provident fund system must be reformed and improved. Expand the scope of deposits to cover new citizen groups. Optimize the use policy and provide financial support for the development of rental housing and the transformation of old urban communities. Further strengthen the information construction of housing provident fund management and improve the level of supervision services.

Yan Yuejin told reporters that the follow-up revision work similar to Guangzhou and Shenzhen is expected to increase in all regions, and all regions will be combined.real estateThe actual situation of the market will truly form a better development of provident fund loans, which can promote the organic link between the provident fund loan policy and the housing market reform policy.

(Source: Brokerage China)

(Editor in charge: DF407)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.