Post Tomorrow for you is a savings insurance product sold by Post Life. It is a’life insurance in mixed form with single or recurring premium whose services are linked to the performance of the Posta ValorePiù separate management in which the premium paid, net of costs, is invested.

The duration of the contract is 7 years.

If you are really looking for information about this product, then read on to find out more!

This article talks about:

A little introduction

The product concerned is offered by Poste Italiane Group: not that there is a need for introductions, but I still want to focus on the group, because I think it is essential to know who is offering the tool we are examining.

As you know, Le Poste was born as an institution dedicated to the management of postal and telegraph services, but over time it has grown to include as many as 30 companies active in various sectors, including finance, insurance and banking.

Poste Vita SpA is the leader in Italy in the life business and assets under management to date exceed 104.3 billion euro against over 3.5 million customers for more than 6.5 million insurance policies placed.

The reliability of the reference company is important, but by itself it does not determine the convenience of the product, it is necessary to analyze the specific characteristics of the contract.

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <

Policy features

Post Tomorrow For You it is a flexible product as it provides:

- a life insurance contract mixed form with single or recurring premium profit sharing;

- an insurance investment product that recognizes a annual performance review in base al performance created by the Separate Management of Posta ValorePiù;

- an insurance coverage that recognizes the designated Beneficiaries the liquidation of the insured capital in the event of the death of the Insured;

- absence of costs for the total redemption and for the first annual request for partial redemption.

As regards the maximum insurance age of the Policyholder and the Insured to be able to sign the contract, make an additional payment and pay the payment of any recurring premiums, it is equal to 85 years.

Poste Vita covers the event of death, and provides for the payment of an amount at least equal to the Premium Paid, net of any partial redemptions and coupons already paid, if the Coupon Option is activated.

In case of total redemption on the other hand, Poste Vita pays an amount at least equal to the Invested Premium, reduced by a percentage equal to the contractually envisaged annual management fee applied for the period of permanence in the contract, taking into account any partial redemptions and coupons already paid, if the Option is activated Coupon.

It’s possible withdraw from the contract within 30 days of the conclusion of the same.

Award

You can choose if pay a single premium equal to or greater than 5,000 euros, up to a maximum of 2,500,000 euros, to invest the savings in a single solution, or provide for a plan of periodic payments with a recurring premium for an annual amount between 600 and 4,800 euros, or for a monthly amount between 50 and 400 euros.

You can also make additional payments, provided they are at least 500 euros each.

It is also possible to request, upon signing or in the course of the contract, the activation of theCoupon Optionwhich consists in the payment every year of a coupon of a variable amount, equal to the revaluation accrued on the contract, net of taxes due, provided that the residual amount in the policy is at least 3,000 euros.

costs

When you want to take out a policy, the part that worries you the most is that relating to management costs and other ancillary costs – we are well aware that all the percentages that the Company retains reduce the value of the final performance.

Let us first look at the case of single premium contract.

We have them issuing costs of the contract which are equal to 10 euros.

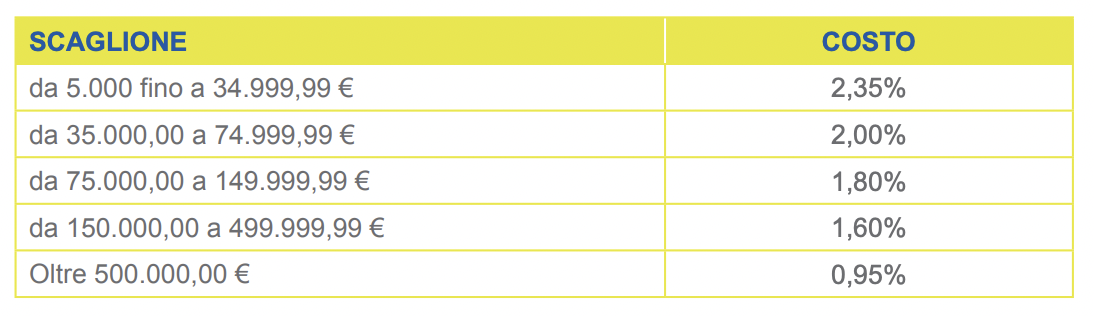

The cost that is applied is determined on the basis of the accumulation of premiums paid, and is differentiated according to the following brackets:

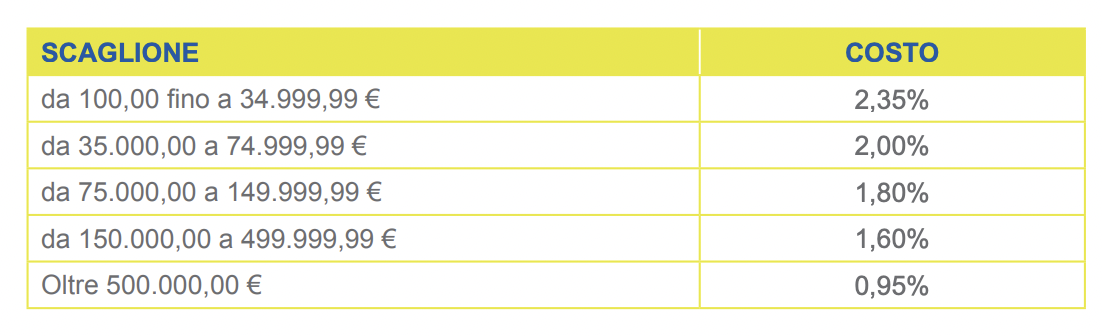

In the case instead of recurring premium contractin addition to the issue costs of 10 euros, we will also have 1.50% of the costs on recurring premiums, and the costs on each additional payment according to these brackets:

I loading costs on the prize and on the additional ones they reduce the amount that will actually be invested, so when you read “return of capital at least equal to the premiums invested” always keep in mind that these are premiums minus costs.

As regards the returns obtained from the Separate Management, the Company retains an annual percentage rate dell’1,20%.

Other non-quantifiable expenses and charges, related to legal and administrative activities, also weigh on the Fund. In other words, here you have double management and therefore the costs multiply.

There is no charge for the total redemption and for the coupon option.

Tax advantages

Let’s see if there are tax advantages, in particular let’s examine the deductions from contributions to life insurance premiums.

You may not know it, but with the entry into force of Legislative Decree n. 47 of 18 February 2000 various levels of deductibility of premiums were established.

In fact, ever since January 1, 2001 it is possible to deduct 19% from the premiums paid for all life insurance, for a total amount that does not exceed 1291.14 euros per year.

To benefit from these deductions, two conditions must be met:

- The stipulation of a contract with a duration of at least 5 years;

- The absence of the granting of loans within the first 5 years of validity of the life policy.

As regards the taxation of liquidated capital, know that the capital is completely exempt from personal income tax, as established by article 34 of the Decree of the President of the Republic n. 600/1973.

Furthermore, the sum of money obtained following the liquidation of the capital of a life policy is unforgivable ed exempt from inheritance charges.

Broadly speaking, remember they are deductible life and accident insurance contracts, concluded or renewed: … If concluded or renewed by this date I am accident insurance relating to the car driver is also deductible, normally in addition to the policy RC car.

Opinions of Affari Miei on Poste Domani for you

Now that you’ve got an idea about the policy, you may be wondering if it’s worth stipulating it. Let’s say that the usual problem of managed savings is i costs too expensiveif compared to the real (very limited) possibilities of return.

One good thing is that this policy does not apply any fees in case of withdrawal and even for the coupon option.

If you follow me you know that I am not too fond of insurance investments, as I like it take care of myself of my money and my investments. In principle, in fact, I do not recommend this type of product, although obviously I cannot know your needs and your personal financial situation.

There are some people who prefer it instead to delegate own money to third parties or in any case to choose ways to invest where the money is managed by others, while taking care not to run too many risks, and this product has a risk profile you seem to 2 on a scale of 1 to 7, so it’s safe from that point of view.

However, I remain of the opinion that investment and insurance are antithetical topics: if you think about it, insurance must protect you, while an investment puts you at risk. Are we sure it makes sense to go down this road?

However, if you are interested in a similar product, then this policy could be for you, although I advise you to read all the clauses and all the quibbles that could arise, because if you decide to divest or change your mind, in that case you would struggle to get out of it unscathed.

Additional resources

If you want to read some more in-depth information, I’ll link you to these targeted investment guides, customized according to the stages of life:

I salute you and I wish you a good continuation!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <